I’ll be watching energy commodities for a major breakout opportunity in tomorrow’s market – and you should too!

I posted a new educational piece today entitled “Pivot Width Analysis (Part 1 of 3)”. In this entry, I explained how I like to use pivot width analysis to find breakout opportunities for the following day. That is, identifying an extremely narrow pivot range can be a great indication of a potential breakout/trending session for the upcoming day.

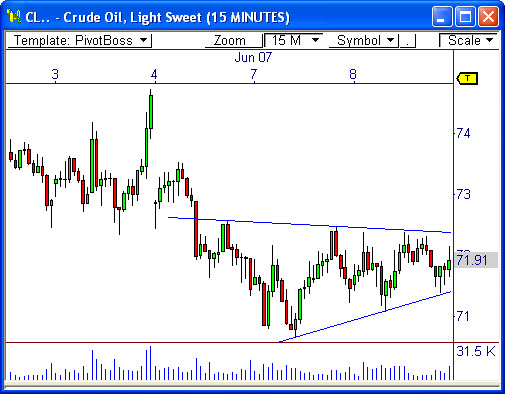

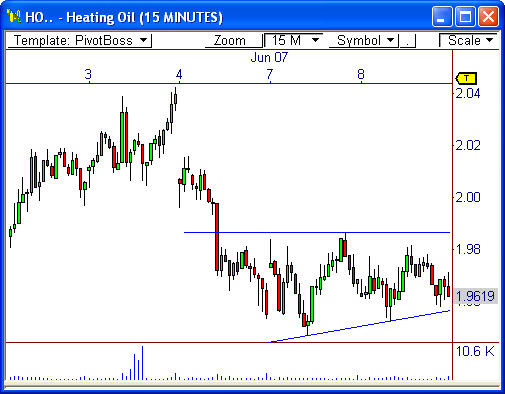

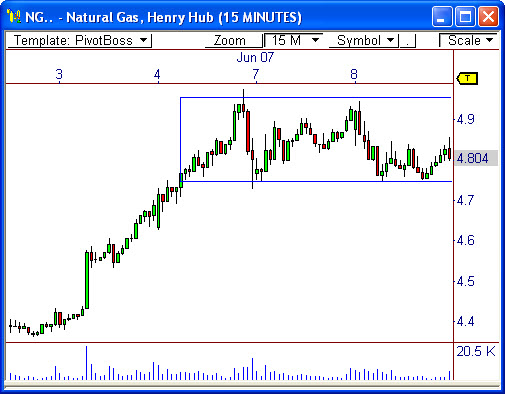

Folks, this analysis reveals that energy commodities, namely Crude Oil, Heating Oil, and Natural Gas futures, are primed for a breakout for tomorrow’s market.

Using an indicator that I call the Developing Pivot Range Indicator (not pictured), I am able to visually see the pivot range for the following session. I’ll explain this indicator in greater detail in a future blog post. For now, just know that the indicator is revealing narrow pivot ranges for these three futures contracts, which could spark big movement.

Notice that each chart has formed a clear consolidation range over the last two sessions. These ranges will help in confirming these breakouts, should they occur.

I don’t know about you, but I’m looking forward to some fireworks tomorrow!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss