The bulls and bears have been battling it out at the pivotal 1,040 support level for the greater part of eight months. The question on everyone’s mind: Will the level be broken, or not?

Traders, analysts, and technicians have all had their say about this extremely important support level over the last few months. And the fact that the SPX is back for it’s second test in three weeks is really heating up the discussion about the index’s next big move.

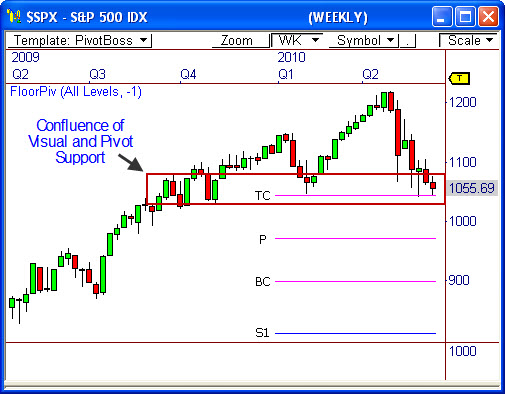

I have been preaching the importance of 1,040 since January because this level coincides with the top of the yearly pivot range at 1,043, as seen in the weekly chart below.

Over the last few months it has been very interesting to watch this level develop in an incredible visual support level as well, thereby creating a powerful confluence of support at this zone.

As it currently stands, 1,040 is the “line in the sand” between bulls and bears. The battle lines have been drawn. The next major trending move will occur as a result of a move away from this level.

A violation at 1,040 could easily lead to a downside continuation back toward 900, while a bounce may spark a move back toward the year’s high.

Which will it be? Give me your thoughts in the comments section below!

Read the following articles for more information on Floor Pivots:

A Quick Guide to the Pivot Range

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss