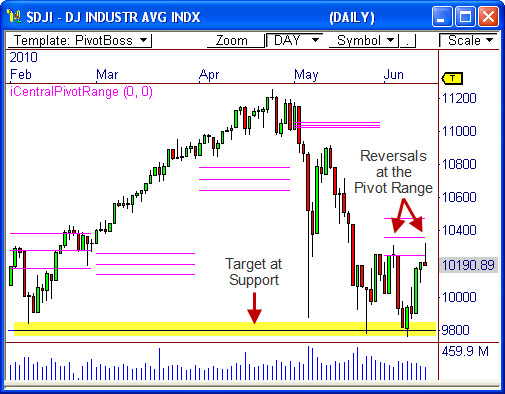

The Dow may be headed for another test at 9,800. Today’s mid-day reversal from resistance at 10,325 all but sealed the deal for another key test at critical support. Here’s why…

The Dow Jones Industrial Average opened the day with early strength today, but found major resistance at 10,325, which has held the last four weeks. The last time the Dow reversed from this level happened two weeks ago, sparking a move to 9,757.

However, the initial reaction to 10,325 was much more apparent this time around, as the index formed a highly bearish candlestick pattern; a shooting star to be precise. This pattern formed precisely at the bottom of the central pivot range, which is considered resistance during an established down trend.

This is the foundation of pivot trend analysis.

During a bullish trending market, bulls will look to “buy the dips” at the pivot range, as this area is considered support. During a bearish trend, however, bears look to “sell the rips” at the pivot range, which is considered resistance. This is what we are currently seeing at the moment.

The Dow experienced heavy selling pressure at the pivot range earlier in the month as well, which indicates we will likely see the same type of result this time around, especially if a confirmed close occurs below today’s low price of 10,185. Therefore, 9,800 could be a real possibility by week’s end.

If 9,750 is taken out, grab a hard hat!

What are your thoughts?

If you want to learn more about the pivot range read “A Quick Guide to the Pivot Range” in our Education section.

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss