Pivot Width Analysis is one of my favorite forms of analysis because it’s simple and it works. This article is Part 2 of a three part series that will take a look at how I use pivot width analysis to forecast price behavior.

If you missed Part 1 of the series, read it here:

“Pivot Width Analysis (Part 1 of 3)”.

In Part 1, I explain how I use the central pivot range to forecast potential price behavior using pivot width analysis. In this piece, I will focus on using the Value Area (from VAH to VAL) using the same analysis.

If you need a Market Profile primer, read my recent article entitled “Market Profile Made Easy”.

What is Pivot Width Analysis?

Pivot Width Analysis involves judging the width of a set of pivots in order to forecast whether the following day (or month or year) will bring about trading range or trending behavior.

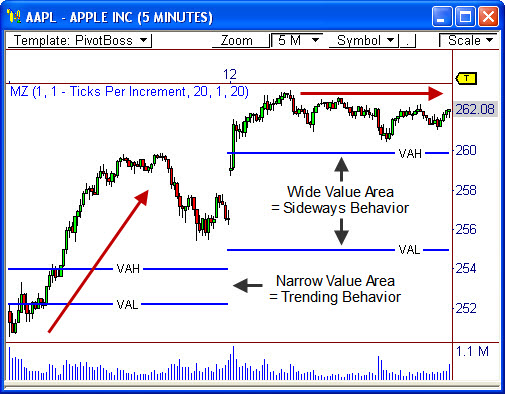

In essence, an extremely narrow Value Area forecasts trending behavior for the upcoming session, while an extremely wide value area forecasts sideways or trading range behavior.

This analysis can also be used to determine price behavior for the next week, month, or year of trading, depending on the lookback of the indicator.

When judging the width of the Value Area, I am referring to the distance between the Value Area High (VAH) and the Value Area Low (VAL).

An extremely narrow Value Area indicates that 70% of the prior day’s trading activity occurred within a very narrow range. This type of behavior can be seen as coiling, which could lead to a significant breakout/trending opportunity in the upcoming session.

On the other hand, an extremely wide Value Area indicates that 70% of the prior day’s trading activity occurred within a wide price range. Typically speaking, when the market forms a wide range of price movement, the following session will see range contraction (sideways or trading range behavior).

Practical Application

Take a look at the chart for Apple, Inc. (ticker: AAPL). Notice that the width of the value area was extremely narrow on May 11th, which led to nice trending behavior during the session. However, given the wide range of price movement on the 11th, the following day saw a wider-than-normal value area, which led to primarily sideways trading behavior. This phenomenon occurs time and again, allowing you to anticipate market behavior with the best of them!

Pivot Width Analysis is very important in my trading regimen because it allows me to anticipate market behavior. Understanding which type of price behavior I am likely to encounter in the upcoming session allows me to deploy my capital in a more informed and anticipatory manner.

In Part 3 of the series, I will show you how I use the Camarilla Equation to engage Pivot Width Analysis – so stay tuned!

Do you use the Value Area in a similar manner? What are your thoughts? Drop me a line in the comments section below!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Pingback: Pivot Width Analysis (Part 1 of 3) | PivotBoss.com

Pingback: Market Profile Made Easy | PivotBoss.com

VALUE AREA has STOPPED EXPANDING for the year. SPY opened under yearly volume based POC today……131.09……

VALUE for the day opened under JULY CLOSING LVA………130.82.

Sold it at open with stop at 131.09.