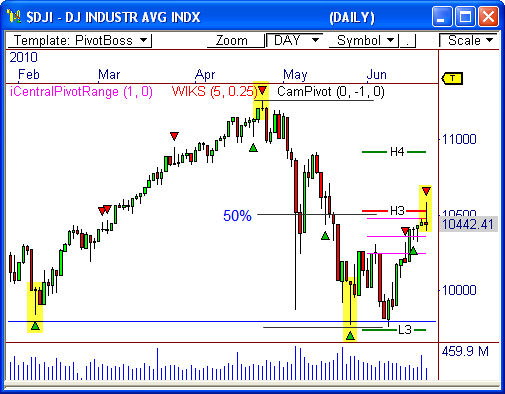

The Dow Jones Industrial Average ($DJI) experienced an incredible reversal today after testing the 10,600 level, which left many people scratching their heads about direction, including me. Fortunately, I’ve got three thoughts on the Dow, which could help to shed some light on future direction.

1. Today’s daily bar candlestick is incredibly bearish.

The Dow opened the session with early strength this morning, but immediately found sellers once price approached the 10,600 level. Price reversed sharply from this area and dropped throughout the session, creating a shooting star candlestick, which is basically a candle with a long shadow (tail or wick) at the top of the bar.

This candlestick formation is highly bearish and foreshadows a potential retracement ahead. Every significant reversal over the last six months has been highlighted by this type of candlestick pattern, as seen in the chart.

However, in order to confirm a bearish reversal, you must see price close below the low of the this candlestick in the next session or two. Therefore, we could see more selling pressure ahead should price close below 10,395 tomorrow.

2. The Dow reversed from the 50% Fibonacci Retracement level.

The shooting star candlestick formed after price tested the 50% Fibonacci Retracement level at 10,508, as measured from the April high to the June low. Coincidence? Maybe. Maybe not.

The fact that sellers aggressively entered the market after price reached the 50% Fib level indicates more selling ahead, potentially back to the 10,180 level, which is the 50% Fib level of the recent rally (June low to June high).

3. The Dow reversed from a major area of pivot confluence.

The tail of today’s bearish candlestick tagged important monthly pivots from both the Floor Pivots indicator and the Camarilla Equation.

The top of the central pivot range was wicked at 10,475, while the H3 Camarilla level was tested at 10,528. The fact that price reacted adversely after testing these pivots indicates weakness ahead.

Again, price must close below 10,395 in order to confirm a decline.

Final Thought: Since the Dow has experienced an impressive 835-point bounce from critical support in just 10 days, the index is due for a retracement. And while a retracement may occur, this does not mean the Dow is done heading higher. This retracement could be fuel for another round of strength ahead.

Let’s see how this turns out!

Have any thoughts you’d like to share? Comment away!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss