The E-Mini NASDAQ 100 futures contract is in the midst of a three-day pull-back after topping out at 1,940 earlier this week. However, more selilng pressure could be seen ahead – at least that’s what my Modified PEMA Crossover signal is telling me.

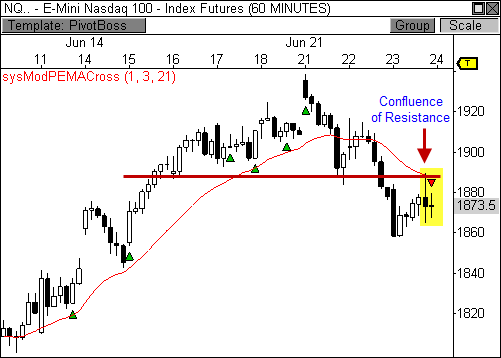

The 60-minute chart of the E-Mini NASDAQ 100 futures contract (NQ) shows price has retraced the last three trading days and is now forming a potentially bearish lower high pattern, which could lead to another round of selling pressure ahead.

In fact, a short signal was fired by a system I created called the Modified PEMA Crossover system, which identifies short term pivot-based EMA crossovers using hidden 1- and 3-period EMA’s, while confirming trend direction using an exposed 21-period average.

Essentially, this system fires signals during pull-backs within established trends.

In this case, a short signal fired in the NQ on the current 60-minute bar, which indicates weakness ahead.

Add to this the fact that price is beginning to show weakness at both the 21-period pivot EMA and a support level that has turned into resistance at 1,890, and we could see a quick drop back to 1,840 soon.

However, confirmation must be seen before we jump in with both feet. Ideally, we want the NQ to close tomorrow’s session below today’s low price of 1,867.50. If this occurs, we could be well on our way to 1,840. Otherwise, a close back above 1,880 could nullify this signal.

Let’s see what happens!

The Modified PEMA Crossover system is featured in my upcoming eBook Profiting with Pivot-Based Moving Averages, which should be available in the next week or two – FREE! Stay tuned!

P.S. I will be in sunny South Padre Island over the next four days, but I will still try to pump out a couple of posts for Thursday and Friday – while working on my tan, of course!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss