The Volatility Index ($VIX) fired off the first step of a key reversal signal after yesterday’s close – one that could spark the next buying opportunity in the broader market. Let’s take a look!

About the $VIX

For those of you not familiar with the $VIX, it’s a measure of implied volatility of the S&P 500 Index options. It’s regarded as the “fear index”, since a rise in the $VIX usually corresponds with a fall in the market. The reverse is also true: a drop in the $VIX corresponds to a rise in the market.

The $VIX is closely followed by many, and with good reason.

About the $VIX Reversal Signal

Back in January, EvilSpeculator featured a post called “VIX Reversal Signal – Day One”, which detailed a powerful $VIX signal that tends to forecast reversals in the market.

Essentially, when the $VIX closes outside one of the Bollinger Bands, this is the first sign that a potential reversal could be seen in the $VIX, thereby having the opposite reversal effect on the broader market.

Yesterday, the $VIX closed the day outside the upper band of the Bollinger Bands indicator, which is the first step of the signal. If the $VIX closes back below the upper band during today’s trading, we will be a step closer to fullfiling the reversal signal. The last step involves a close price that is lower than the close of the bar from Step 2. This would complete the trifecta.

Therefore, if the $VIX closes back below the upper band (below $32.65-ish), we could be on our way to seeing a reversal of some magnitude in the broader market.

Summing Up the $VIX Reversal Signal

EvilSpectator sums up the rules as follows:

For a $VIX confirmed signal you need 3 events:

A close outside of the 2.0 Bollinger Band (20-day SMA)

A close back inside the 2.0 BB – this issues the signal

A higher close (sell) or lower close (buy) than the close of the day back inside the 2.0 BB – this confirms the signal.

By the way, I know I’m using a 13-period MA to calculate the Bollinger Bands, but I have found this periodicity to be reliable as well.

Relating this to the S&P 500

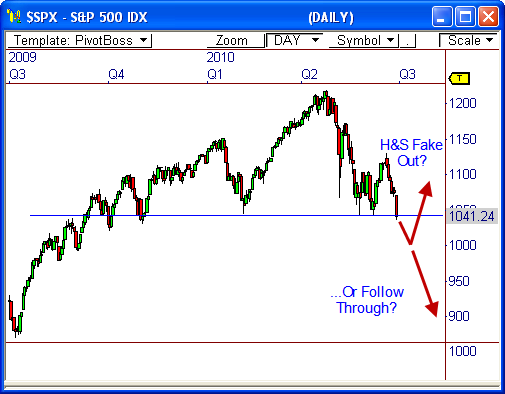

After yesterday’s tremendous drop, the market is now testing critical support levels across the board.

The S&P 500 Index is sitting right on 9-month support at 1,040, which is also the neck line of a super-large head-and-shoulders pattern that can be seen from the Moon.

I wrote about this pattern in the post “H&S Forecasts 860 in the S&P 500”.

While this pattern implies major weakness ahead, we have to be mindful of a potential “fake out” occurring, whereby the neck line is violated, but in turn leads to a huge surge of buying pressure.

If the $VIX Reversal signal comes to fruition, this could lead the S&P 500 back to 1,100 over the next week of trading.

If the $VIX Reversal signal doesn’t fall back within the Bollinger Bands, then say “Hello” to $VIX 45 and S&P 500 900!

Am I crazy? What are your thoughts? Drop me a comment!

By the way, props go out to my trader buddy Kevin for pointing out the potential $VIX Reversal signal to me yesterday. He keeps me on my toes!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Pingback: Revisiting the $VIX Reversal Signal | PivotBoss.com

Pingback: Watch the $VIX | PivotBoss.com

Pingback: Is the $VIX Signaling a Market Reversal? | PivotBoss