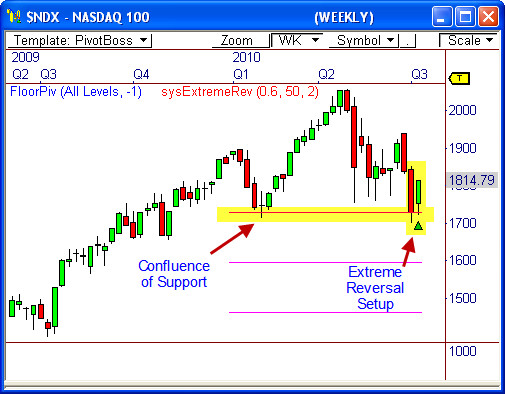

The NASDAQ 100 Index ($NDX) is testing major support and has also formed a very bullish candlestick pattern that could lead price higher. Let’s take a look.

Yearly Support

The weekly chart of the $NDX shows price has formed a clear area of support from 1,700 to 1,710 through the first six months of the year. Price tested this area of support the last two weeks, and was able to maintain a bullish stance above this zone.

This area of support has become so clear, that it resembles the neck line of a large head-and-shoulders pattern, which could lead to a major violation and sell-0ff, or a bullish reversal after a failure to break. Time will tell.

This visual area of support also coincides with the top of the yearly pivot range at 1,727, which we know to be a very important range of support as well. If 1,700 continues to hold, we could see a brilliant advance back toward the high of the year.

However, if a violation occurs through 1,700, a quick drop to 1,600 becomes very likely.

Read more about the Pivot Range HERE.

The Rubber Band Trade

The weekly chart also shows the $NDX has formed what I call a bullish extreme reversal candlestick pattern – or the rubber band trade, as it is commonly known. This pattern occurs when price overextends itself in one direction, and then snaps back in the opposite direction from being overextended.

Similar to a rubber band that has been stretched too far – let go of one end and it snaps back toward the opposite extreme.

Two weeks ago, price formed a bearish candlestick that was at least two times larger than the average size of the candlesticks over the last year of trading. This is the “overextended” candle.

Last week, price formed a bullish candlestick, which shows that price had already begun to “snap back”. Given that this pattern formed at yearly support indicates that we could see an upside continuation back toward the 1,900 level.

The candlesticks of the last two weeks also form a bullish harami candlestick pattern, which is also bullish.

I’ll give you a better write-up on the extreme reversal setup soon, which will get posted to the Education Page.

With earnings season kicking off this week, it could get a little dicey, though.

Stay on your toes!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss