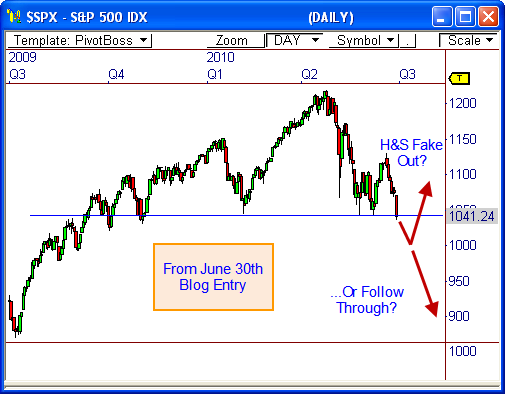

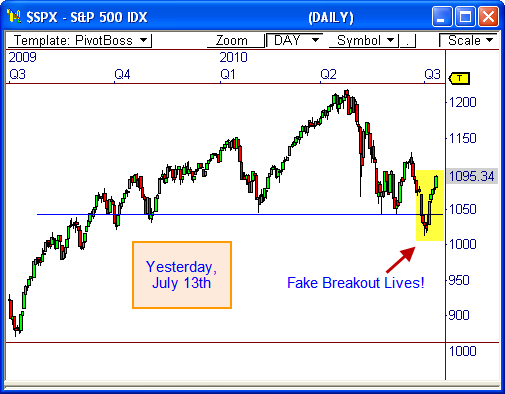

I wrote about the $VIX Reversal Signal in my June 30 entry entitled “Follow the $VIX”. So far, the $VIX Reversal Signal has been money…but so has the H&S fake breakout I diagrammed on the S&P 500!

Fake Breakout

In the June 30th entry, I wrote:

“While this pattern implies major weakness ahead, we have to be mindful of a potential “fake out” occurring, whereby the neck line is violated, but in turn leads to a huge surge of buying pressure.

If the $VIX Reversal signal comes to fruition, this could lead the S&P 500 back to 1,100 over the next week of trading.“

As you see below, I diagramed the potential for a false break of the neck line at 1,040, which would then introduce buyers into the market, thereby pushing price to 1,100.

Since then, the scenario has played out perfectly, with price coming within a half point of hitting 1,100! I’ll consider that a victory.

But what now?

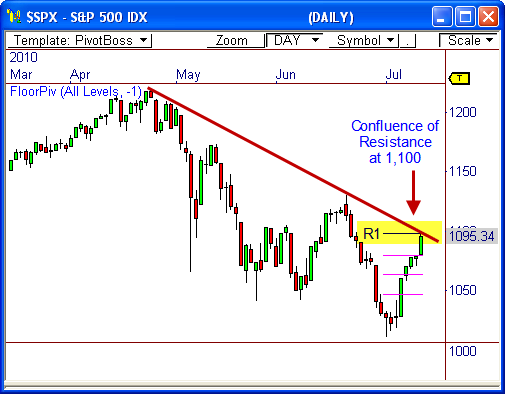

Confluence of Resistance

The S&P 500 Index is now testing a major area of confluence at 1,100, which means price is at a crossroad.

The $SPX is testing a 4-month upper trend line that has paced the recent decline since April. Moreover, R1 resistance from the Floor Pivots indicator for the month of July is 1,098.50, thereby forming a clear area of confluence. Also, the monthly Value Area High (VAH) sits just above at 1,108 (not pictured).

Clearly, if the S&P 500 is to continue higher, it must bulldoze through significant resistance.

Otherwise, we could see a period of sideways activity that paves the way for another downside reversal back toward 1,055 – or lower.

While the market has increased in volatility over the last four months, it is very impressive how orderly price movement has become.

Let’s see how price responds to 1,100!

Summer Lecture Series

By the way, don’t forget, I’ll be the guest speaker for TTTHedge.com’s Summer Lecture Series today at 12PM ET. Space is limited, so log on early! Did I mention it’s FREE? READ MORE HERE!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss