Last week, I wrote about the 1,000-point triangle pattern in the Dow Jones Industrial Average, which finally went into full “breakout mode” late in the week. The S&P 500 Index (SPX) is getting the initial break through the top of its triangle, too, which forecasts a move back to 1,200…but it might need a little help from the $VIX.

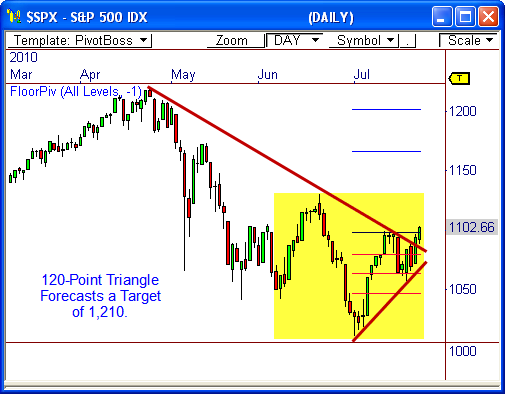

120-Point Triangle

The daily chart of the S&P 500 shows a large triangle pattern has built out over the last six weeks of trading. This triangle is well-defined, has good spacing and geometry – and forecasts a move of 120 points, using the back end measurement.

The fact that price finally violated the top of the triangle pattern AND crossed above the prior price pivot of 1,100 indicates a full-blown breakout has occurred.

Since the breakout has occurred between 1,090 and 1,100, a target of 1,210 to 1,220 is anticipated, which would put price back at the year’s high of 1,219.80.

The next major area of resistance to test would be 1,130, though.

However, even though a breakout has occurred, the index may still need some help to reach its destination.

$VIX at Major Support

The daily chart of the $VIX shows price is sitting above the critical support level of 23.00, which has held the last three months and was an important resistance level before that.

If the S&P 500 is to head higher, the $VIX will likely need to get a major violation of 23.00 soon. A break at this level could lead the $VIX back toward recent lows at around 15.25, which last occurred when the $SPX reached 1,200.

While the triangle shows a breakout has occurred in the $SPX, a bit of caution should still be used in the early stages – since the index has been in the midst of a four-month downtrend.

If the $VIX bounces higher from support, a big failure of the S&P triangle could occur, which would push price back toward 1,000.

However, don’t be surprised if you look up in three to six weeks and see price back at 1,200.

Let’s see how this plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss