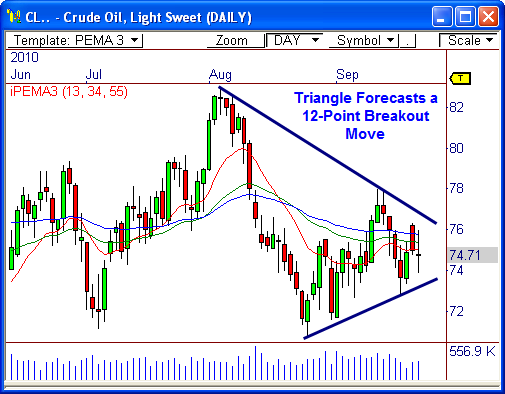

Crude Oil (CL) has had decent price swings over the last few months, but September has been fairly dry, thus far. However, Crude could be on the verge of a major breakout opportunity – one that could push price 12 points in the direction of the breakout!

Triangle

The daily chart shows Crude Oil has been coiling within the boundaries of a developing triangle pattern, which has formed since August. Since the backend of the pattern spans 12 points, a breakout from this pattern should spark a 12 point move – which is a big for this commodity.

Also, you’ll notice that all three of the pivot-based moving averages are basically flat, or neutral. This usually occurs just before a major breakout opportunity, which I call the PEMA Breakout. You can read more about this setup in my FREE eBook Profiting with Pivot-Based Moving Averages.

I’ll be watching $76.75 and $73.25 for early breakout scenarios. However, a breakout will only be confirmed once price closes beyond a prior price pivot – $78 up, or $72.75 down.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss