I’m back from Spain! It was a fantastic trip, but I’m ready to jump back into the saddle. Here are my quick thoughts on what I see in the S&P 500..

Bullish GPZ

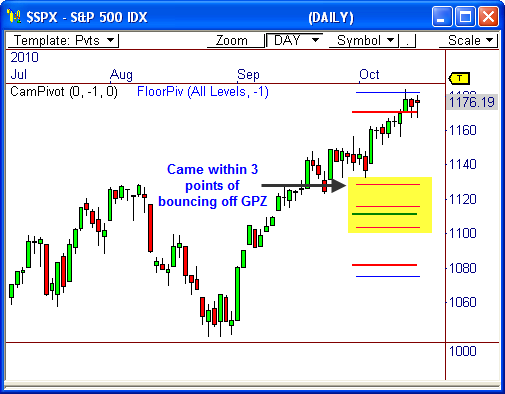

In the last blog entry I wrote before I left (THIS ONE) I mentioned that a near-term retracement could be seen in the market, which could offer a buying opportunity. Since a bullish GPZ had formed, the market was bound to test this zone before rallying to new highs, which was indeed the case. Most major indexes either tested this zone or came within mere points of testing it, before launching to new highs.

As a matter of fact, the S&P 500 came within 3 points of testing the zone before rallying over 50 points. Impressive!

Stalling

The market has now stalled at highs over the last three sessions, which means we could see a breakout scenario ahead. The 15-minute chart of the S&P 500 shows price is coiling and has a very narrow value area for today’s market. This could mean a trending session if Friday’s range is violated early in the day.

Since the market has trended steadily higher the last two weeks, look for a potential downside move out of this range. Keep in mind, however, that weakness has opened the door to buyers over the last two months. Therefore, a sell-off should be fleeting, as most market participants will again see a retracement as a bargain-buying opportunity. This has been the pattern the last two months and will continue to be the pattern until it is broken.

Long Term

The S&P 500 continues to remain very bullish above the long term fulcum level of 1,130. This should continue to remain the case, even if a longer term retracemet occurs. The market looks determined to test 1,200 and even rise as high as the year’s high at about 1,220. Therefore, look to continue to buy weakness as long as the market remains above 1,130.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss