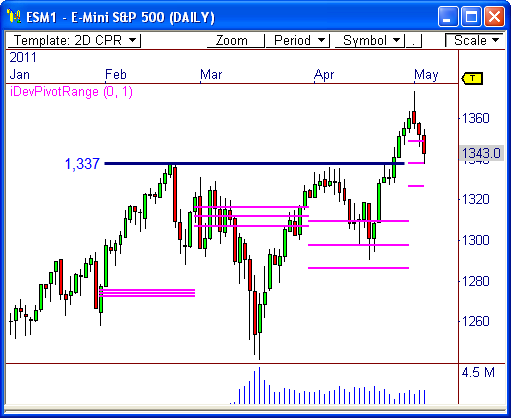

The E-Mini S&P 500 futures contract has experienced selling pressure after reaching new multi-year highs earlier in the week. This weakness could open the door for a potential buying opportunity ahead…especially if 1,337 holds.

Pivot Range Support

The daily chart shows the ES has dropped nearly 40 points the last three days after putting in a new high for the year earlier in the week. However, the index pulled back precisely to the 1,337 level and began to see initial signs of buyers. As a matter of fact, 1,337 holds major significance and could prove to be the level to watch.

The 1,337.50 level happens to be the central pivot point for the month of May. When price tested this level intraday, higher timeframe buyers entered the market almost immediately, which shows that big players are eager to “buy the dip” during this minor correction.

Also, the fact that a two-month Higher Value relationship has formed indicates that bulls are looking to buy into weakness at the pivot range, which is precisely where the ES closed the session.

If the market is going to find buyers for another ride higher, this is the zone.

Formerly Resistance, Now Support

The 1,337.50 level was also major resistance for the contract from February through April recently. Interestingly, after the breakout in late April, price has pulled back to retest this zone, which could become support if buyers are able to defend this level.

So, as you can see there’s a fair bit of confluence in this zone, which could lead to a very nice buying opportunity ahead if 1,337 continues to hold firm. If so, we could see a very nice advance to new highs ahead, potentially to the 1,400 level. Otherwise, a failure through 1,337 could spark a drop back toward 1,310 in the days ahead.

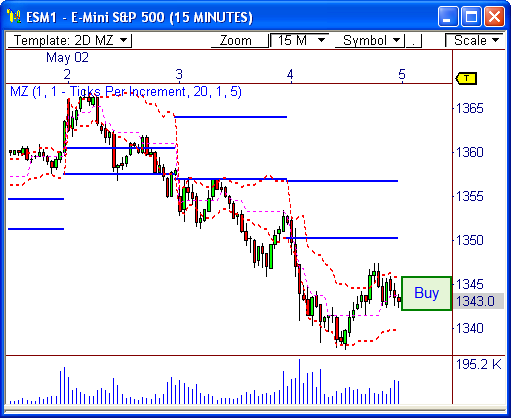

The Game Plan

If price opens the session above 1,346 tomorrow, I’ll be looking to buy into weakness between 1,342 and 1,346. A drop into this zone could lead to a very nice advance toward 1,361, which happens to be a Virgin Point of Control (VPOC), and potentially higher in the days ahead.

If the market cannot defend 1,340 (and especially 1,337), we will likely see more near-term weakness ahead…likely toward 1,327, and then to 1,310.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss