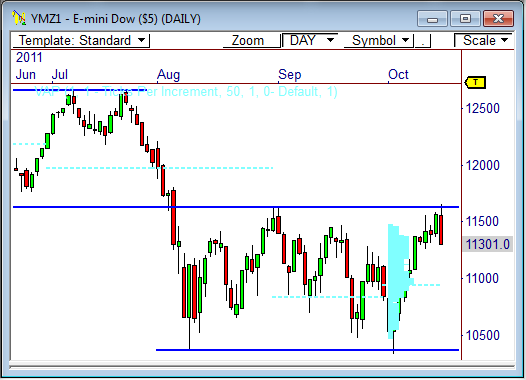

The mini Dow futures contract was rejected at significant resistance at 11,650 today, which triggered a heavy sell-off throughout the session. Recent history indicates more downside could be seen…

Resistance at 11,650

The daily chart shows the mini Dow futures contract ($YM_F) was sternly rejected at the 11,650 resistance level early in the session, which led to a session-long sell-off. Today’s 247-point decline could be just a drop in the bucket, as the last time the Dow reacted to this zone it eventually dropped to lows in the 10,320’s.

As a matter of fact, the Dow has built out a well-defined trading range over the last three months, which spans from 10,320 to 11,650, and has taken several passes within this channel. More trading range activity is likely to persist until the market is ready for price discovery outside this range.

Outside Day

An hour into the market this morning, I tweeted the following, “This certainly has an outside day feel to it…no surprises here..” Nearly six hours later, the YM confirmed my suspicions and developed a bearish outside day candlestick pattern.

If you are not on Twitter, I suggest you create an account and start following me and others in the trading community, as this medium has proved to be a very powerful way for traders to connect and learn from each other.

My twitter handle is @PivotBoss.

As you may know, I am a big fan of the outside day candlestick pattern, especially when it coincides with significant resistance. Coincidentally, this pattern formed the last time price tested the current resistance level on September 1.

This type of pattern clearly illustrates that OTF responsive sellers rejected price levels above 11,650 and swiftly smacked down the market. What usually follows is more downside activity.

Targets

If the YM clears the 11,300 support level, which has held firmly the last six sessions, we will likely see the index push toward several targets, including naked POCs at 11,096, 10,961, and 10,452. Also, keep an eye on the monthly VPOC at 10,945.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss