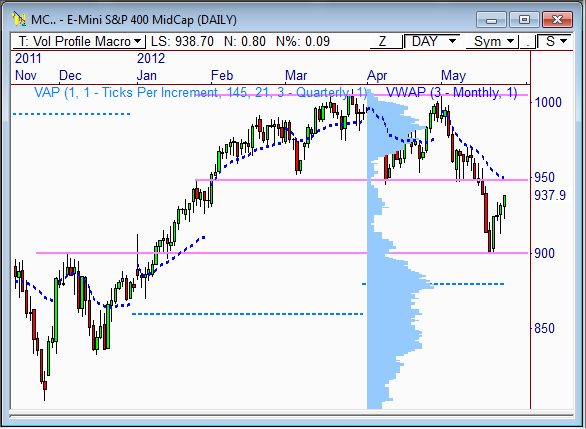

After enduring nearly three weeks of heavy selling pressure, the E-Mini S&P 400 has experienced a nice rebound this week off the 900 level. One last push could put price right back at the prior area of support before the next drop occurs. Here’s why..

LVAs

The daily chart shows the MCM2 held at clear support at 948.5 for over three months before seeing a clear violation in mid-May. The break at this level opened the door to the 900 which, in turn, offered a nice bounce this week.

The composite Volume Profile shows the break at 948.5 was a Low Volume Area (LVA), which is a zone that typically offers major support (or resistance). A violation of a LVA can oftentimes lead to a big release of energy, which was indeed the case.

Notice that the 900 level was also a LVA, which held as support after the recent decline.

Target to Watch

Given that the MC has rebounded nicely from the 900 level, we must now begin to theorize how high price might go in the days ahead.

All signs point to a test back at 948.5. Not only was this level visual support for three months, it is also the most significant LVA in the chart. Furthermore, the monthly VWAP currently sits just above this zone, creating a solid zone of confluence.

As is usually the case, price must retest prior support before it can continue onward with new price discovery. As such, we could see price retest 948.5 before another drop occurs. A rejection between 948.5 and 950 could open the door to another test a 900, with the potential for a drop to 880 in the weeks ahead.

However, if price can test, and hold above 948.5, another round of buying pressure could be seen. It all depends on how price reacts at the 948.5 battle line between the bulls and bears.

Higher Value

The 15-minute chart shows price has formed a two-day Higher Value relationship, which falls in line with our theory of testing 948.5 ahead. If price opens above 935, look to buy into any morning weakness between 930.8 and 935, with upside targets at R1 at 943 and LVA resistance at 948.5.

If price opens the session below 927.5, then we should shift our focus to the downside. Look to sell into morning strength between 927.5 and 930.8, with a target at the micro LVA of 924.5 and the next naked VPOC of 916.8.

FREE WEBINAR (and 10% OFF!)

From now until the end of May, if you purchase a product from the PivotBoss Shop you’ll receive a FREE live webinar hosted by yours truly in June. Don’t forget, you’ll also receive 10% off your entire purchase by using the coupon code “HELP”. PivotBoss is also donating 20% of its proceeds during this time to the Bihlmaier College Fund, which you can read more about HERE and HERE.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow Frank on Twitter: http://twitter.com/PivotBoss