The E-Mini S&P 400 futures contract (EMDZ2) closed Thursday’s session within the boundaries of a two-day range that could be the catalyst for the next major breakout opportunity. Here’s more…

Inside Value Setup

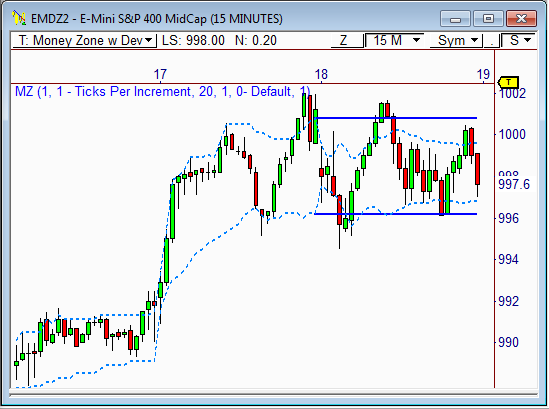

The 15-minute chart shows the EMD has formed an Inside Value relationship for Friday’s market, which tends to forecast great momentum opportunities. You’ll notice the developing value area indicator (dotted lines) both closed within the value area (blue lines) from Thursday’s session, which essentially illustrate that price is coiling up ahead of a breakout.

Resistance at 1,000

The 60-minute chart shows the two-day range has formed precisely at resistance at 1,000, which is a level that has had a lot of play over the last two months. Since September, the E-Mini 400 has traded above and below 1,000, making it a clear fulcrum between bulls and bears.

In essence, a breakout in either direction from the Inside Value pattern should spark big movement. However, given Thursday’s late-day price behavior, a downside break is most likely to occur at this time.

Additionally, the EMD has held below the monthly H3 Camarilla pivot all month long, which sits at 1,004. Any downside move away from this level could spark a serious move.

The Game Plan

Ideally, we’ll want to see price open the RTH session outside of the prior day’s price range. Therefore, we’ll look to enter Shorts should price open the day below 994.5. I won’t be picky, though, as an open below 996 should work just fine. Since the current 10-day ADR value is 11.3, we’ll look to play to the following targets: 990.3, 987.5, and 984.7.

If price opens the session with a gap above 1,002, we’ll want to be long with targets at 1,005 and 1,008.

If price opens between 996 and 1,000, we’ll sit on our hands for now.

Don’t forget, if you buy my book Secrets of a Pivot Boss in the month of October, you’ll receive a free live webinar in November! Click for Details.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow us on Twitter: http://twitter.com/PivotBoss

[cc_h_line color=”888888″]

[cc_list_posts post_type=”post” amount=”3″ img_position=”left”]