PB View

It seems like the entire market is coiling. Nothing is moving, but everything has huge potential for movement. Like the market, I am in “wait and see” mode, and we have a slew of reports and news out today that could finally influence a breakout in a wide variety of markets.

Today is the last day of testimony for Fed Chairman Bernanke, which begins at 9am CT. However, there are few reports slated for release between 7:30am and 9:00am (see below), which could put a little pep in the step of the market.

I’ll be watching the range boundaries for each of the key markets below, as confirmed breakouts in either market could spark decent follow-through. Crude seems the most eager to move, so watch the top of the range closely today.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

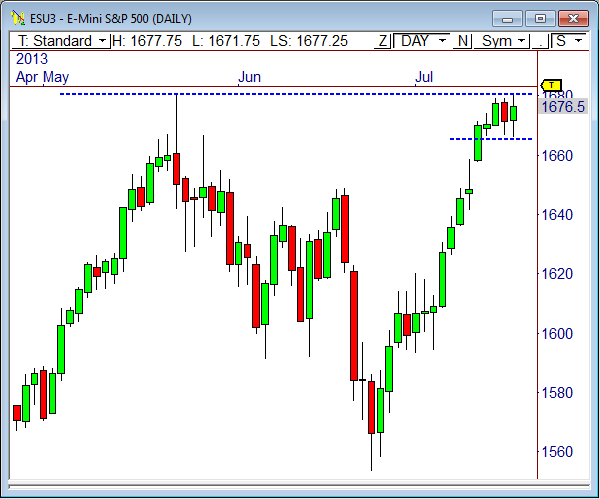

E-Mini S&P 500

In yesterday’s ES report I wrote, “the ES has formed its first lower value pivot range relationship in nearly two weeks, which has a bearish bias for today’s session. However, price needs to break below the 1665 level in order to confirm weakness into last week’s open gap.”

The ES dropped right into the 1665s a few hours before yesterday’s RTH open and found buyers, essentially sealing the level as support and pushing price back toward the 1680 level, where price traded between 1673 and 1680 for much of the day.

The daily chart shows the ES continues to hold at the high of the year and is stuck within a very narrow four-day range, which spans from 1665 to 1680. As a matter of fact, after 3 full days of trading this week, the ES has a range of just 14.75 points – for the week! Summer trading is here, but it’s also clear that price is coiling up ahead of its next move.

If price can push through 1680.50 and get a solid breakout through the top of the four-day range, then I think the weekly bull target at 1699.25 comes into view. However, a failure at highs could result in a test of the 1665 support zone which, if broken, opens the door to the weekly bear target at 1647 by the end of the week.

Here’s the day’s economic calendar:

7:30am CT Unemployment Claims

9:00am CT Fed Chairman Bernanke Testifies

9:00am CT Philly Fed Manufacturing Index

9:00am CT CB Leading Index m/m

9:30am CT Natural Gas Storage

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ES) | |||||

| Jul 18, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,685.75 | YTD High | ADR (5) | ONH | ONL | |

| 1,683.50 | Fib Ext | 12 | 1,677.75 | 1,671.75 | |

| 1,680.50 | PD High | AWR (10) | WH | WL | |

| 1,679.75 | LVN | 44.75 | 1,680.50 | 1,665.75 | |

| 1,677.25 | HVN | ||||

| 1,675.00 | SETTLE | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,673.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,672.75 | PD Low | 1,686.75 | 1,671.75 | 1,710.50 | 1,646.94 |

| 1,670.50 | nVPOC | 1,683.75 | 1,668.75 | 1,699.31 | 1,635.75 |

| 1,669.75 | Fib Ext | 1,680.75 | 1,665.75 | ||

| 1,666.25 | LVN | 1,677.75 | 1,662.75 | ||

| 1,664.25 | nVPOC | *BOLD indicates primary objectives | |||

| 1,660.50 | LVN | ||||

| 1,656.00 | HVN | ||||

| 1,652.25 | LVN | ||||

| 1,648.75 | Open Gap | ||||

| 1,644.75 | cVPOC | ||||

| 1,644.50 | nVPOC | ||||

| 1,637.25 | HVN | ||||

| 1,635.00 | nVPOC | ||||

E-Mini NASDAQ 100

In yesterday’s NQ report I wrote, “The 3064 level offers a great zone to watch for a violation today, as a break of this level could push price toward 3057.50, 3055, 3047.75. If 3064 continues to hold, an early move above 3076 could forecast 3079.75, 3086.50, and 3094.”

The E-Mini NASDAQ 100 held above 3064 yesterday and got the early push above 3076, leading to a test of 3079.75 and 3086.50, which became the high of the day. While the NQ’s 5-day ADR has been dropping quickly, it still fell shy of its average daily range of 23.75, as it only traded within a 21-point ETH range, and only 16.25 points during RTH. Again, price is coiling and we have to be ready should a breakout occur.

Short term, the most significant level on the chart remains 3064. As long as the NQ remains above this zone, we are likely to see price trail higher within the current trend, likely toward the weekly bull target of 3137.50, which seems far considering there are only two days left in the week. However, if 3064 is broken, look for a push toward the weekly bear target of 3011.75 by the end of the week. Again, seems like a far off target, but recent price compression suggests a breakout could spark a decent attempt.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQ) | |||||

| Jul 18, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,096.25 | Monthly H5 | ADR (5) | ONH | ONL | |

| 3,092.75 | Fib Ext | 23.75 | 3,078.75 | 3,068.25 | |

| 3,086.50 | PD High | AWR (10) | WH | WL | |

| 3,084.50 | LVN | 99.75 | 3,086.50 | 3,062.75 | |

| 3,080.25 | SETTLE | ||||

| 3,079.50 | VPOC | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,075.50 | cVPOC | BULL | BEAR | BULL | BEAR |

| 3,070.25 | PD Low | 3,097.94 | 3,066.88 | 3,162.50 | 3,011.69 |

| 3,069.75 | nVPOC | 3,092.00 | 3,060.94 | 3,137.56 | 2,986.75 |

| 3,064.25 | Fib Ext | 3,086.06 | 3,055.00 | ||

| 3,062.75 | LVN | 3,080.13 | 3,049.06 | ||

| 3,056.75 | nVPOC | *BOLD indicates primary objectives | |||

| 3,048.75 | LVN | ||||

| 3,029.50 | nVPOC | ||||

| 3,027.50 | LVN | ||||

| 3,011.50 | HVN | ||||

| 3,008.00 | nVPOC | ||||

| 2,997.00 | Open Gap | ||||

| 2,995.00 | nVPOC | ||||

Crude Oil

In yesterday’s Crude report I wrote, “Wait for the market to decide direction, then act upon the move. Eventually a breakout through either 104.20 or 107.50 will occur. And when it does, we could easily see a 3- to 5-point move in Crude.”

Different day, same analysis. Crude continues to develop within a tightly-wound compression range, which has lasted six sessions. Eventually, this range could deliver the next major move in this commodity, so continue to watch it closely.

The range is slowly converging toward an apex, which means a breakout could occur soon. Short term, watch LVNs at 106.77 and 105.02 as resistance and support, respectively. A break through either of these levels could start the initial party for a breakout. However, look for further range movement until this occurs.

The weekly bull target is 109.51, and the bear target is 102.04. If a breakout occurs during today’s session, one of those targets could be the next destination by the end of the week.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CL) | |||||

| Jul 18, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (5) | ONH | ONL | |

| 107.71 | Monthly R3 | 2.02 | 106.73 | 106.15 | |

| 107.46 | LVN | AWR (10) | WH | WL | |

| 106.86 | Fib Ext | 6.48 | 106.90 | 104.65 | |

| 106.77 | LVN | ||||

| 106.52 | PD High | DAILY TARGETS | WEEKLY TARGETS | ||

| 106.48 | SETTLE | BULL | BEAR | BULL | BEAR |

| 106.24 | LVN | 108.68 | 105.72 | 111.13 | 102.04 |

| 105.97 | VPOC | 108.17 | 105.22 | 109.51 | 100.42 |

| 105.92 | cVPOC | 107.67 | 104.71 | ||

| 105.62 | PD Low | 107.16 | 104.21 | ||

| 105.54 | LVN | *BOLD indicates primary objectives | |||

| 105.28 | Fix Ext | ||||

| 105.02 | LVN | ||||

| 104.37 | LVN | ||||

| 104.20 | LVN | ||||

| 103.52 | Open Gap | ||||

| 103.36 | Monthly R2 | ||||

| 103.34 | LVN | ||||

| 103.27 | nVPOC | ||||

| 103.03 | HVN | ||||

Gold

In yesterday’s Gold report I wrote, “Gold continues to build out within a very tight 5-day range, which has developed right in the middle of the monthly pivot range. As stated above, the fact that this range has formed at this spot in the daily chart indicates a major swing move will occur once a breakout occurs.”

Gold continues to build out within a clear 5-day range, and is setting the boundaries for the next breakout move. I missed a Short entry yesterday by 4 ticks after price spiked to 1299.70 and missed the sell-off back to short term support. However, after all was said and done, GC remained within its range from 1265 to 1300.

Ultimately, Gold must get a decisive break through either 1265 or 1300 to spark the next swing move in this commodity. Once a breakout occurs, look for price to move toward one of its weekly targets, which are currently 1323.60 up, and 1245.40 down.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GC) | |||||

| Jul 18, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,316.50 | Fib Ext | ADR (5) | ONH | ONL | |

| 1,312.60 | 34PEMA | 25.3 | 1,282.00 | 1,273.30 | |

| 1,311.20 | Fib Ext | AWR (10) | WH | WL | |

| 1,301.30 | Monthly TC | 72.40 | 1,299.70 | 1,269.30 | |

| 1,300.90 | 50% Fib | ||||

| 1,300.00 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,299.70 | PD High | BULL | BEAR | BULL | BEAR |

| 1,293.50 | LVN | 1,304.93 | 1,269.35 | 1,341.70 | 1,245.40 |

| 1,293.40 | VPOC | 1,298.60 | 1,263.03 | 1,323.60 | 1,227.30 |

| 1,291.10 | Monthly H3 | 1,292.28 | 1,256.70 | ||

| 1,285.90 | LVN | 1,285.95 | 1,250.38 | ||

| 1,283.70 | cVPOC | *BOLD indicates primary objectives | |||

| 1,277.40 | SETTLE | ||||

| 1,275.80 | Monthly Pivot | ||||

| 1,275.20 | LVN | ||||

| 1,272.10 | LVN | ||||

| 1,269.30 | PD Low/LVN | ||||

| 1,260.80 | LVN | ||||

| 1,257.80 | Fib Ext | ||||

| 1,255.00 | HVN | ||||

| 1,254.10 | nVPOC | ||||

| 1,243.60 | LVN | ||||

| 1,234.20 | nVPOC | ||||