The last two weeks have offered some amazing moves in the market, even for a day like today, which saw tons of back and forth action within a range that accounted for just 66% of average.

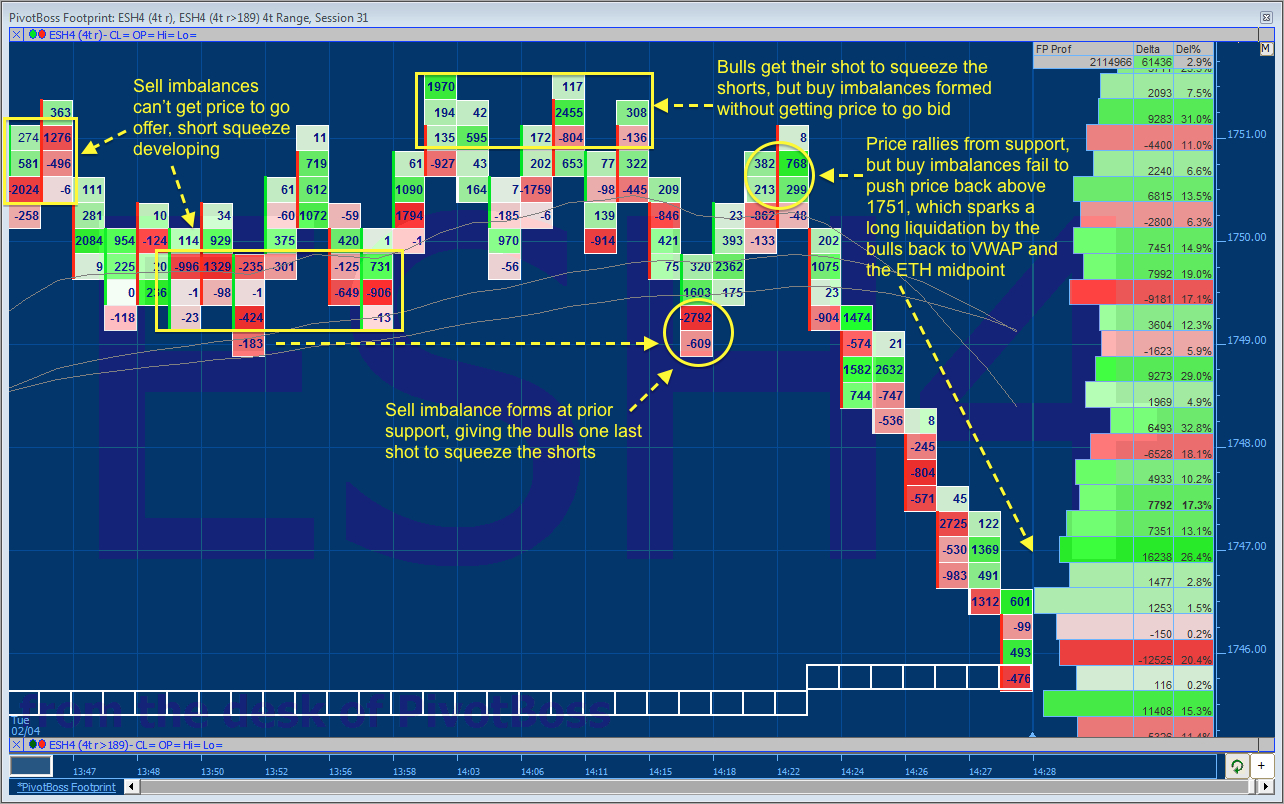

In particular, the ES stood out today in the footprint, as it became evident that a large passive seller (or sellers) was absorbing bids at 1751, which led to three consecutive late-day sell-offs, despite a mountain of buy imbalances. This could be very telling about future price direction, as some big fish seem to be building short positions.

Check out the footprint chart below, which explains the second reversal off 1751, and also be sure to watch the video below, which details each of the three reversals through the lens of the footprint.

Charts and videos like these are updated daily for our Premium Members.

Catch a Replay of Our “Open House”!

Thank you for attending our open house for our Premium Membership! We’ve received great feedback since the event, and I wanted to pass along the video in case you missed.

Catch Me in Austin

I’m speaking to the Austin Association of Financial Traders (AAFT) Wednesday, February 5! I’ve got a great topic for you: Trader Candy, Order Flow, and Live Market Observations. I’d love to see you there!

Here are the details:

Date: Wednesday, February 5, 2014

Time: 7:00 to 9:00pm CT

Where: Terrazas Branch, Austin Library

(1105 E Cesar Chavez St, Austin, TX 78702)

See you soon!

Cheers!

Frank Ochoa

Follow me on Twitter: @PivotBoss