Here’s how I nailed my recent Gold calls, along with a super-charged info-graphic.

Responsive Buyers Defend Value at 1256.50

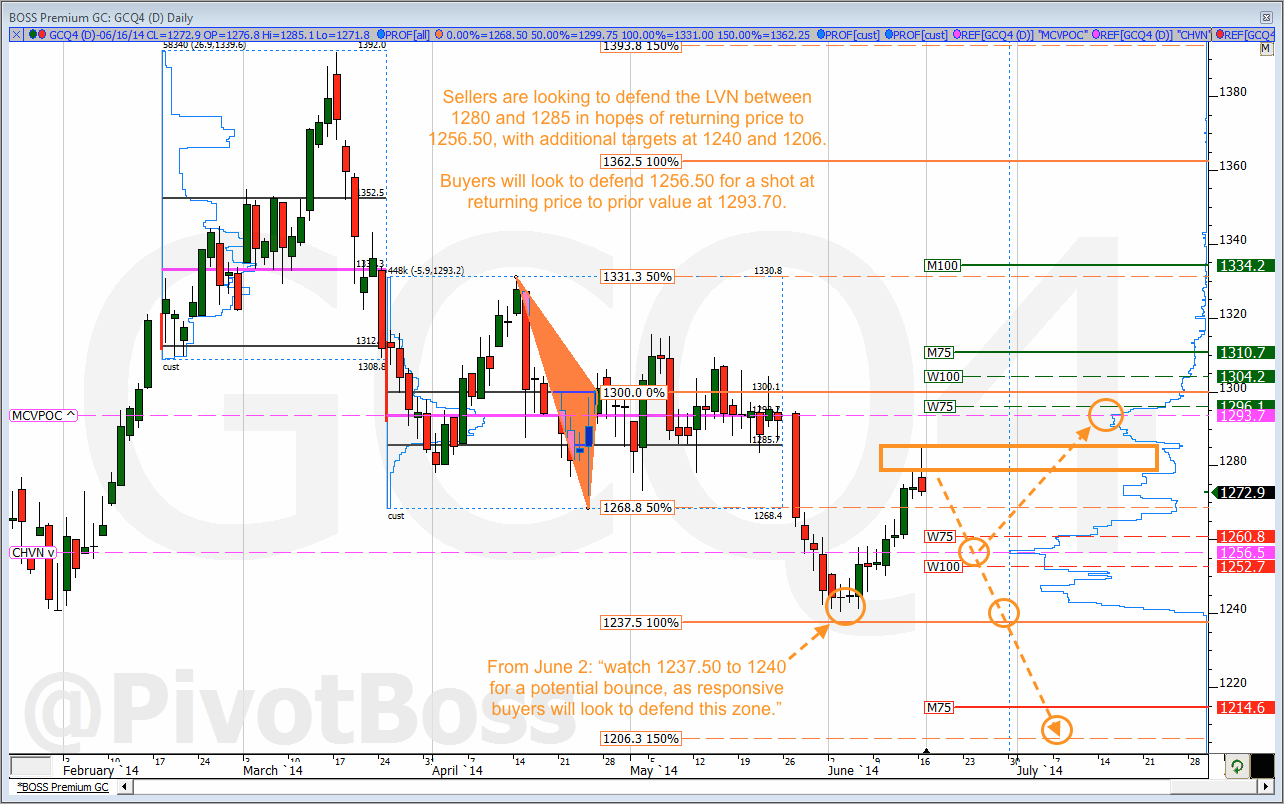

In the June 17 edition of the Opening Print (Another Markdown Coming in Gold) I wrote: “If sellers are able to defend 1280 to 1285, look for the market to retest value at 1256.50. Sellers must be able to take this price offered if new lows are to be seen…Keep in mind, buyers took 1256.50 bid recently after defending 1240, which means they’ll be looking to defend value upon the first retest in hopes of returning price to prior value at 1293.70.”

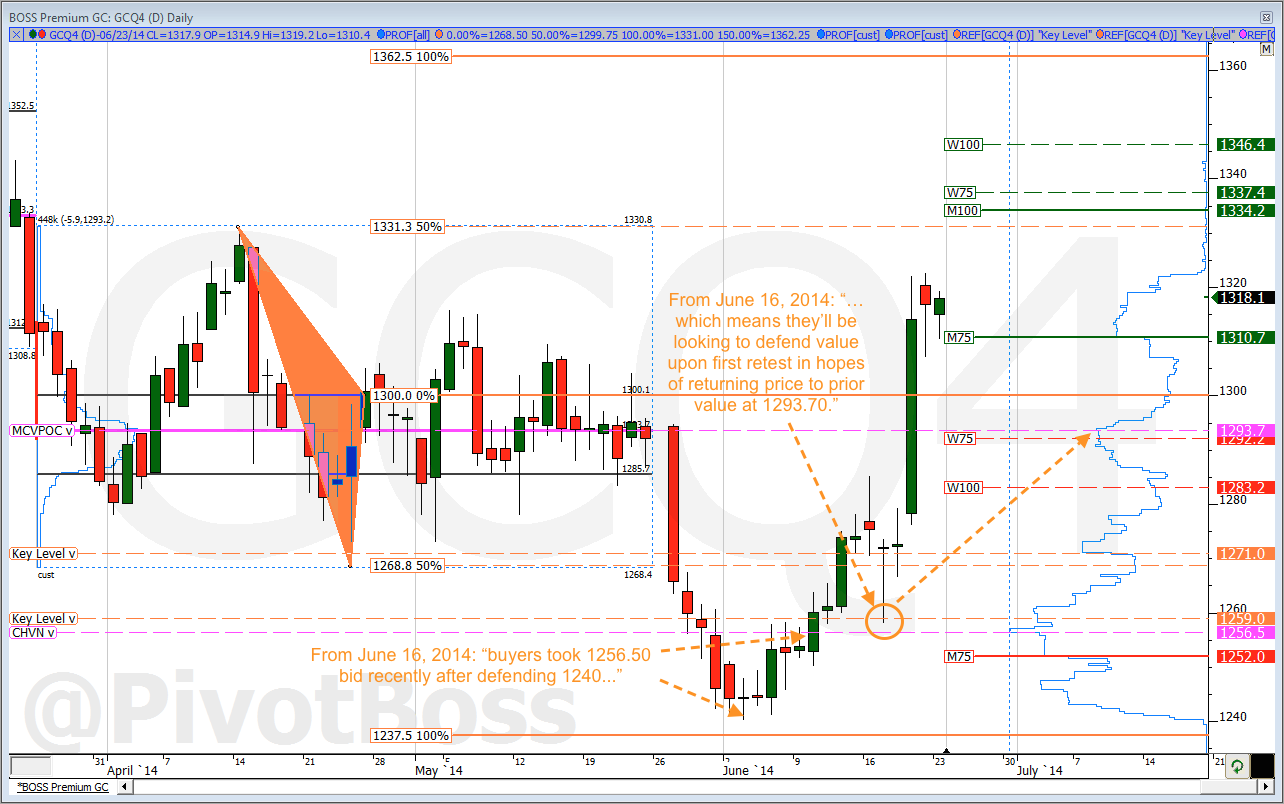

Not only did responsive buyers defend value at 1256.50, but they also forced the bears out of their short positions by squeezing the upside buy stops, which lifted price to our 1293.70 target, and through it for another 30 points. In all, last week’s spot-on call was worth an easy 60 points, with no heat and all reward.

This was the chart that was attached with that post:

And here’s a current chart of Gold:

How was I able to identify the right key levels, and how was I able to know where certain market participants were positioned, or looking to enter the market?

This call was all due to understanding the role of value in the market, and in learning to anticipate where buyers and sellers want to enter their trades, defend their trades, and where they are forced to exit their trades.

Learn to Anticipate The Moves of Market Participants

Trading is much like a game of chess, where the best competitors are able to anticipate many moves into the future. Traders must be able to know where the bulls are positioned, where they want to defend, and where their stops are. Traders must also be able to read where the bears are positioned, where they want to defend, and where their stops are. Experienced traders don’t favor a directional bias, they join the winning side.

When you’re able to read the market in this way, you’re essentially reading the true auction of the market, and can have a much great feel for who’s winning the current battle, and who’s stops are about to be run. Just join the winning side.

Additionally, traders must be able to accurately identify value in the market for multiple timeframes, which is no easy feat since value is the most dominant variable in the market — it changes constantly. Again, the best traders will know value in at least three timeframes, and will also note all value shifts, as these become extremely important in understanding who is winning the immediate battle at newfound value or prior value.

Why do I write all this? Because, this is true market-generated information that can help you trade any market, in any market environment, in any timeframe. It’s the truest form of price and volume-based analysis, along with auction-market principles. It’s not just about price ticking up or down, it’s about actual traders and orders that are either making money, or being forced to cover. Just join the winning side.

So Here’s What Happened in Gold

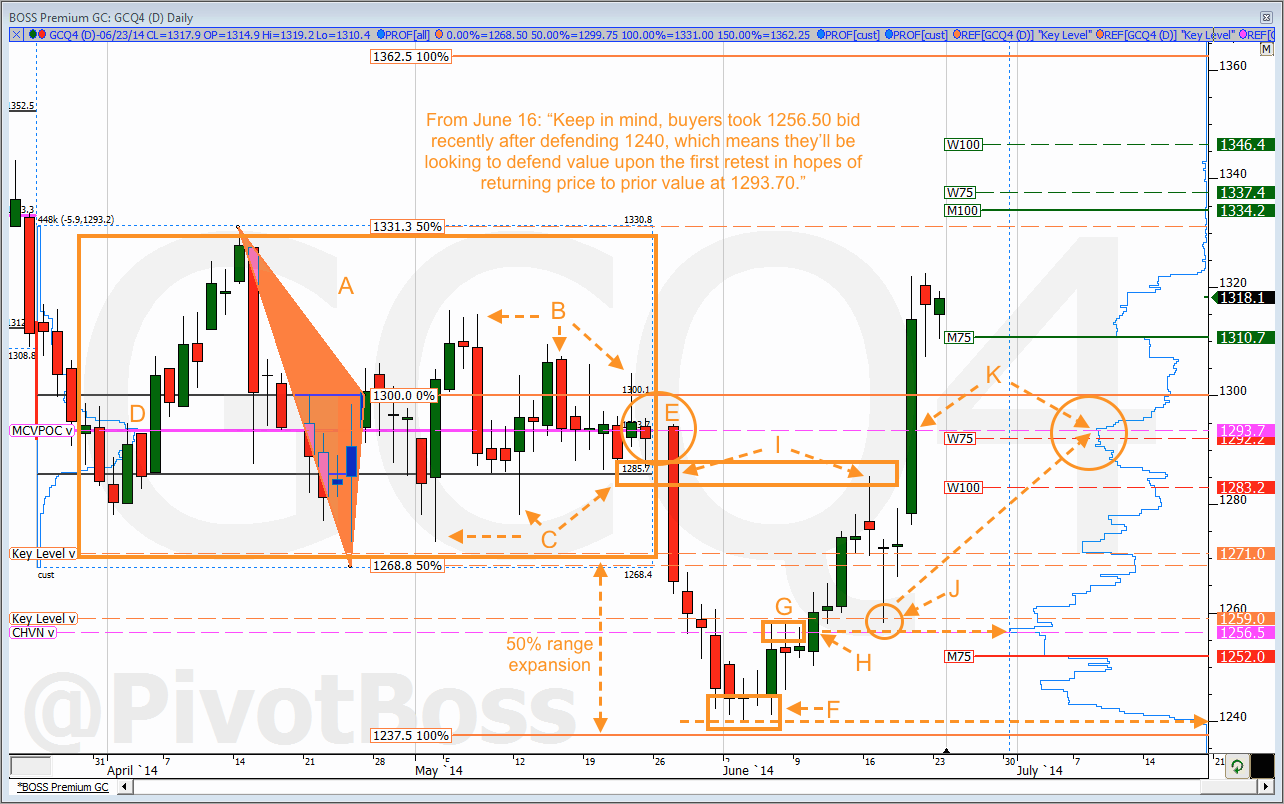

Now that you have a better understanding of the back story to our prior calls in Gold, here’s a move-by-move breakdown of what’s happened in the Gold market the last few months:

A. Price trades in a 2-month trading range, which is a compression phase that typically precedes an expansion phase.

B. Responsive sellers fade the market above the 1300.10 value area high (VAH), and place their buy stops above the recent highs.

C. Responsive buyers fade the market below the 1285.70 value area low (VAL), and place their sell stops below the recent lows.

D. Price establishes value at 1293.70, which is the volume point of control (VPOC) of the 2-month range. This price generated the most volume among market participants within the range, which means there are now more buy stops above the highs and more sell stops below the lows. These stops build the energy for the next phase of expansion.

E. Gold chops around value at 1293.70 for several days as buyers and sellers take sides. Eventually, Gold goes offered through 1293.70 and triggers the downside sell stops of the buyers that had been defending prices below VAL. What does this mean? Going offered through value means the market is now rejecting this price as value, which means the market will likely spark a downward price discovery phase to either retest prior value, or establish new lower value.

F. Price drops to within 2.50 points of the 50% expansion target at 1237.50, as bears begin to take profits off the 1240 level by buying to cover. Price drops enough to entice passive buyers off the sidelines, and they begin to defend the 1240 level for several days.

G. Price establishes value at 1256.50, and responsive sellers begin to absorb demand at this level in hopes of keeping value as resistance.

H. Eventually, initiative buyers squeeze the sellers out of their positions by triggering the upside buy stops above 1256.50, thus successfully taking value bid.

I. Price rallies into the VAL of the prior 2-month range at 1285.70, and responsive sellers defend this level in hopes of taking value offered at 1256.50 en route to new lows.

J. Sellers successfully defend prior VAL and a retest of value occurs near 1256.50, but this level is staunchly defended by responsive buyers. Mind you, theses are the same buyers that took price bid through 1256.50 the first time, and the same buyers that initially defended the 1240 level weeks earlier.

K. A massive short squeeze takes place above 1280, as the buy stops begin to get triggered of the sellers that had defended the 1285 level just three days prior. The short covering rally sparked a move back to prior value at 1293.70, and through it for another 30 points. Remember, when the market successfully defended value at 1256.50 during the retest it was a sign that the market was likely headed to prior value at 1293.70 for a retest, as it was the level that had initially triggered the earlier selloff into 1240. Again, it’s all about value.

Cheers!

Frank Ochoa

PivotBoss Premium | Premiere Analysis for Professional Traders

PivotBoss Masters | Premiere Training for Professional Traders

Pingback: Gold is Coiling Ahead of Expansion | PivotBoss