After reaching our first key target at 3890, the Nasdaq 100 continues on its bullish path toward 4000.

First Target Reached at 3890

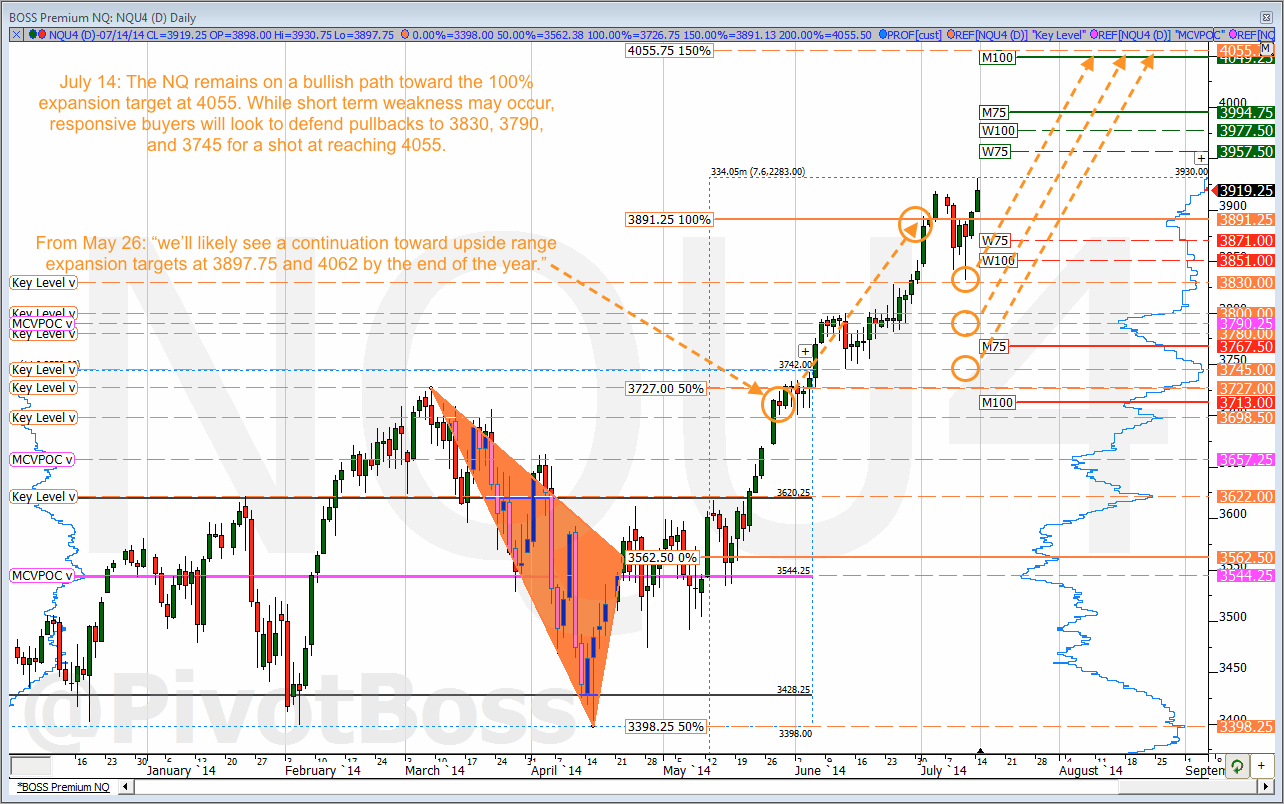

In the May 26 edition of the Opening Print (Bulls Remain in Control of the Nasdaq) I wrote: “While the NQ could see further development within the overall range from 3405 to 3733.25, be on the lookout for expansion down the road. An eventual breakout could spark a significant trending move in the direction of the break, likely toward the 50% and 100% range expansion targets over the course of a six-month period…we’ll likely see a continuation toward upside range expansion targets at 3897.75 and 4062 by the end of the year.”

When I last wrote about the Nasdaq 100 [NQU14:CME] seven weeks ago I talked about the increased potential for expansion from the six-month trading range, and for the likelihood that the NQ would continue higher toward two key targets, namely 3897 and 4062. And nearly two months later, we’ve already reached our first upside target at 3890, and seem poised to easily reach 4000 by the end of the year, if not by the end of the summer.

Equally impressive is the fact that the NQ has rallied over 200 points during this time, and most of it came without a significant pullback until last week. And in typical fashion, the NQ rallied to new highs Monday just days after last week’s “sell-off.” Again, this clearly shows the bulls remain in full control of the market, and every pullback remains a buying opportunity.

4055 is the Next Major Expansion Target

As you may recall, the targets I offered for the NQ were simply expansion targets from the six-month range that developed from 3398.25 to 3727, which are levels that have been adjusted for the September contract. Since the expansion occurred through the top of the range, the expectation was for a move to the 50% and 100% expansion targets, which are 3891.25 and 4055.75.

Currently, the NQ is trading above the 50% expansion target of 3891, and is attempting to establish acceptance above the 3830 key level. If the market maintains acceptance above 3830, look for the bulls to squeeze the shorts into 4055, which could occur by the time the September contract expires.

Keep an eye on 3920 for early directional cues this week. Responsive sellers will be looking to take 3920 offered for a shot at 3830. Failure to hold above 3830 opens the door to a wider retracement, likely toward the recent high volume node at 3790, which will act as a magnet.

Keep in mind, however, a drop into 3830, or even 3790 and 3745, is likely to be defended by responsive buyers, as these levels were bid the last time the market traded there. Again, pullbacks should be seen as buying opportunities until proven otherwise.

Cheers!

Frank Ochoa

PivotBoss Premium | Premiere Analysis for Professional Traders

PivotBoss Masters | Premiere Training for Professional Traders