Gold tests 2-year support level, with a shot to rally big into the end of the year.

2-Year Support at 1184

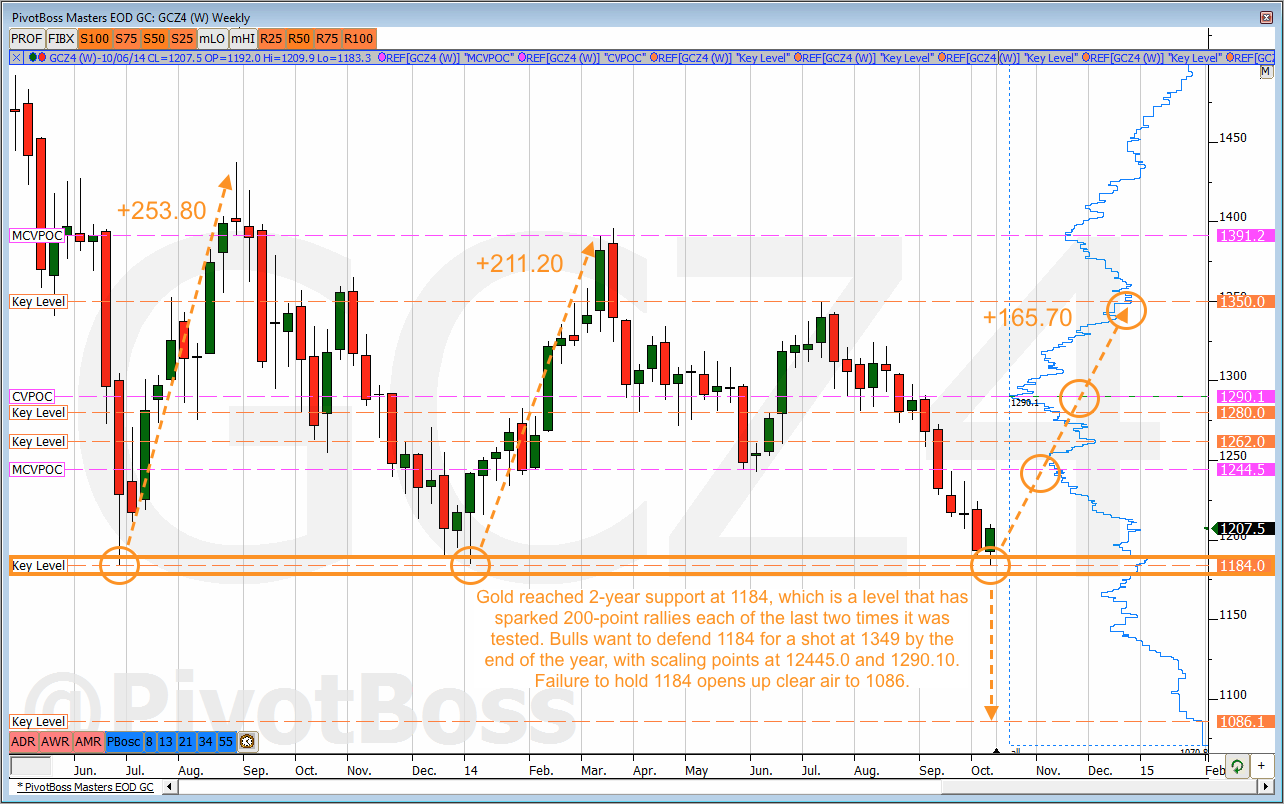

Gold Futures [COMEX: GCZ14] has found 2-year support at 1184, which is a significant support level that has held firmly on two previous occasions. In fact, the first test of the level occurred in June of 2013, and went for over 250 points back to the 1450 level. The second test of 1184 came earlier this year in January, and also sparked a 200-point rally back to 1400. Keep in mind, both of these rallies took between two and three months to complete.

As you can expect, buyers were eager to defend the 1184 level again, and got their change Monday. Price dropped into 1184 and saw an immediate reversal, which culminated in an aggressive 25-point rally back above 1200. Keep in mind, while this may not seem like a huge move, Gold has been extremely bearish in recent months and has had a tough time finding a bid. So this first test, and defense, opens the door to a potential rally back across value toward the top of the 2-year trading range.

1349 in the Cards

Given the rejection that has been seen in Gold off the 1180s in recent years, it’s not out of the question for price to see another round of strength back toward the top of the 2-year trading range at 1349. The 1349 level is the first significant LVN above the 1290 composite VPOC, which is important to note because price tends to go from rejection (LVN) to acceptance (VPOC), and back to rejection (LVN). So in this case, we could be looking at price reversing off rejection at the 1184 LVN to acceptance at 1290 CVPOC, and back to rejection to the 1349 LVN.

In essence, we could see a 165-point rally over the next three months heading into the end of the year, with scaling points at 1244.50, and 1290.10.

Bears to Defend 1244.50

Let’s not kid ourselves, though. Gold has been extremely bearish since topping out above 1900 in September of 2011. Every rally has been a bear market rally so far, so sellers still have the upper hand in the longer term picture.

Bears will be looking to defend MCVPOC at 1244.50 upon its first retest, for a shot at running the downside sell stops through 1184s. Should this occur, we could see a swift 100-point sell-off into the next key support level below at 1086, with more to go.

Keep an eye on the prior week’s high, as well, as Gold has yet to breach a prior week’s high in over two months. In this case, all eyes will be on 1224 to see if the bulls are for real, or if the bears will once again eat bull meat on the way down.

Cheers!

Frank Ochoa

Author of the book Secrets of a Pivot Boss

Pingback: Gold Rallies 60 Points from Buy Zone | Forex Protocol News