The E-Mini NASDAQ 100 futures has experienced significant downside expansion in October, but how much lower can prices go?

Contraction Leads to Expansion

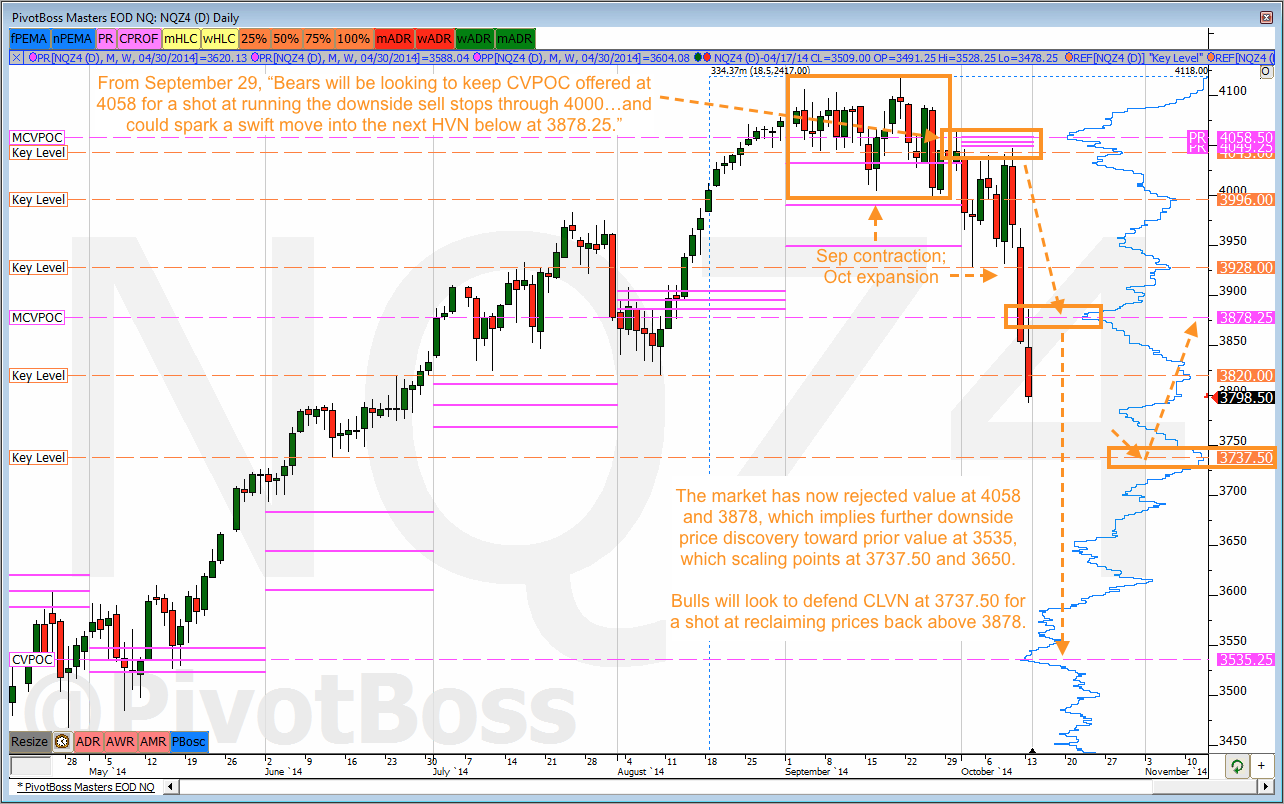

The E-Mini NASDAQ 100 futures [CME: NQZ14] has experienced significant downside expansion so far in the month of October, which I warned about on September 29, when I wrote, “the NQ has a range of just 120 points in September when it’s been averaging over 200 points per month on a 10-month average basis. That is, the NQ has only traded 56% of average monthly range…What does this mean? It means price found balance in September, and is likely ready for imbalance (expansion) in October. Watch the boundaries of the range (4000 to 4120) for significant expansion ahead.”

So far, the NQ has traded 255.25 points of range in the month of October, which puts it at 123% of average monthly range, with more than half of the month still left to trade. This is exactly what you would expect after the month of contraction that was seen in September, but more downside could be seen ahead, especially after the bears took 3878 offered during recent trading.

Market Rejects Value

In that same article from September 29, I also wrote, “Bears will be looking to keep CVPOC offered at 4058 for a shot at running the downside sell stops through 4000. Failure to hold the LVN between 3983.75 and 4000 would be significant, and could spark a swift move into the next HVN below at 3878.25.”

While brief, the statement above is extremely important because it reveals how the market operates. Acceptance or rejection of value reveals important market insight and helps connect the dots as to where price could be headed in the upcoming period of time.

The fact that the bears were able to successfully defend CVPOC (value) at 4058 was a clear sign that the market was rejecting current value. When the market rejects current value, it begins a price discovery phase to either seek new value or trade to prior value. In this case, the market traded to prior value at 3878…and did so in a mere few days.

Market also Rejects Value at 3878

Ideally, bulls will defend pullbacks to value or defend the LVNs ahead of those levels in an uptrending market. That is, unless the market is in a serious corrective phase. While subtle, it appears the market has already rejected the 3878 MCVPOC, as well. Rejecting this level implies further downside price discovery toward the next value area below. At this time, the next significant HVN below is 3535.25, which is value from the first five months of the year.

In essence, we could see more selling pressure toward 3535 in the weeks ahead, especially if the bulls cannot reclaim prices back above 3878.

The Game Plan

Short term, bulls will look to defend the composite LVN at 3737.50 for a shot at retesting prices back above 3820 and into 3878. The 3737.50 LVN shows clear rejection in the composite profile, which is typically good for a bounce, even while within a short term bear trend. Bears will look to defend pullbacks to 3878 and 3928 for a shot at pushing price into 3700, 3535 and 3390.

While recent selling pressure appears ugly on the surface, keep in mind that the market remains within a stellar five-year bull trend. Every significant pullback during this period of time has offered opportunities to buy low and sell much higher. As I’ve continued to say, pullbacks remain buying opportunities until it stops working.

Cheers!

Frank Ochoa

Author of the book Secrets of a Pivot Boss