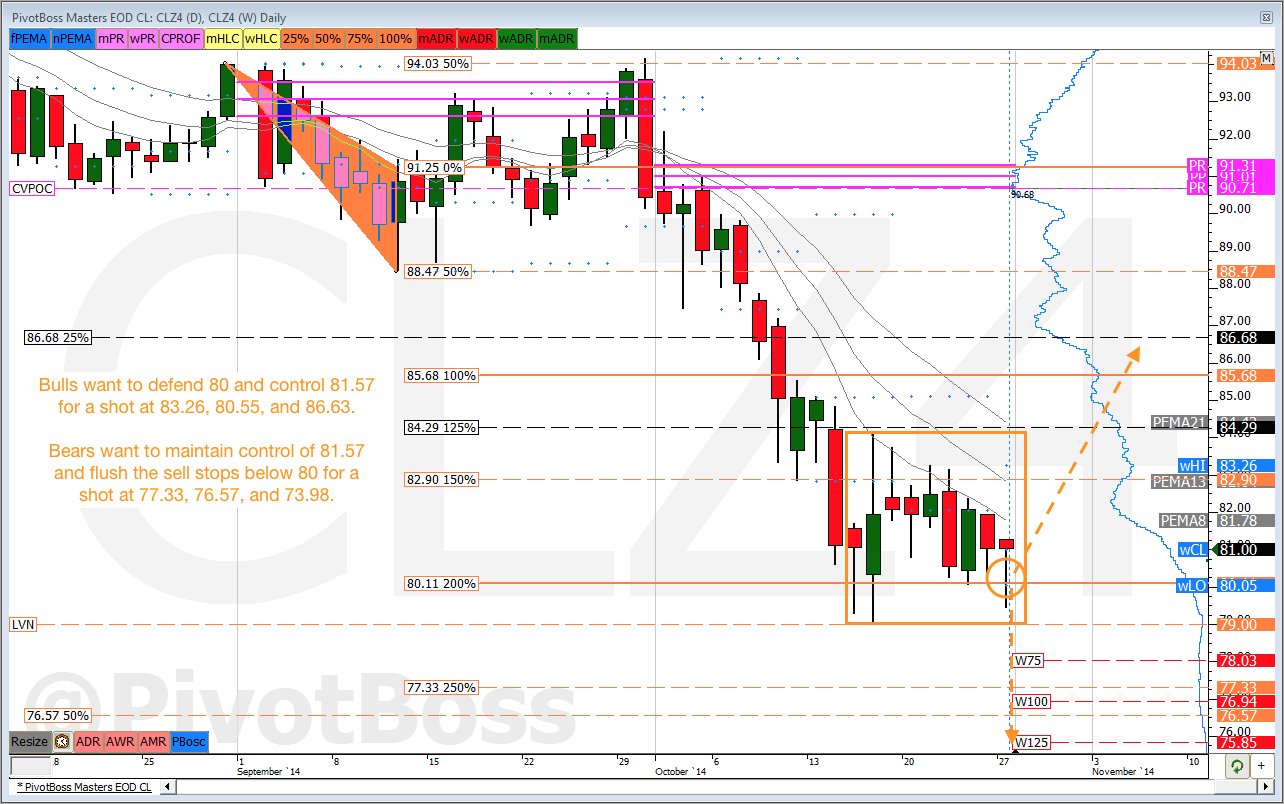

Crude Oil has been dominated by bears in recent weeks, but appears to have found rejection below 80.

Market Rejects Prices Below 80

Crude Oil futures [NYM: CLZ14] has experienced steady selling pressure ever since price topped out at 95 late in September. Price has sold off 16 handles since the 95s, but appears to have finally found rejection below 80.

As a matter of fact, Crude Oil has tested prices between 79 and 80 on four occasions in the last two weeks, and each time closed the session back above 80. This pattern of rejection, along with the CLVN at 79, opens the door to a potential squeeze higher, likely into the previous week’s high at 83.26.

81.57 is the Pivot

Keep 81.57 on your screen, which is the center of the impulse move that occurred after the rally from 79. The bears currently control this level, implying further near-term selling pressure ahead. Bears want to take out stops below 80 for a shot at 79, 77.33, and 76.57.

Keep in mind, bulls will be looking to defend the previous week’s low of 80.05, for a shot at taking price bid through 81.57 and into the previous week’s high of 83.26. And if the bulls can reestablish acceptance above 83.26, much more upside could be seen, likely into 85.36 and 86.63.

Given recent rejection below 80, the 80.05 previous week’s low remains the major level to watch for early directional bias. Failure to hold this level, and certainly a daily close below it, would easily pave the way to new lows into downside targets at 77.33 and 76.57, with a shot at 73.98.

The path of least resistance is still down, but bulls have a shot for a decent bounce if they can defend 80.

Cheers!

Frank Ochoa

Author of the book Secrets of a Pivot Boss