The E-Mini S&P 500 futures failed to establish acceptance above 2072.25, which triggered recent selling pressure. Here are the plays to watch for.

Failed Range Expansion

Price ranges offer extremely important market-generated information, which is vital to understanding where price has been, and more importantly, helps you forecast where price could be headed.

In the case of the E-Mini S&P 500 futures [CME: ESH15], it was failed range expansion that triggered recent selling pressure. As a matter of fact, failed range expansion is one of the best true indicators of an upcoming reversal in price, so it pays to pay attention to this very telling market tendency.

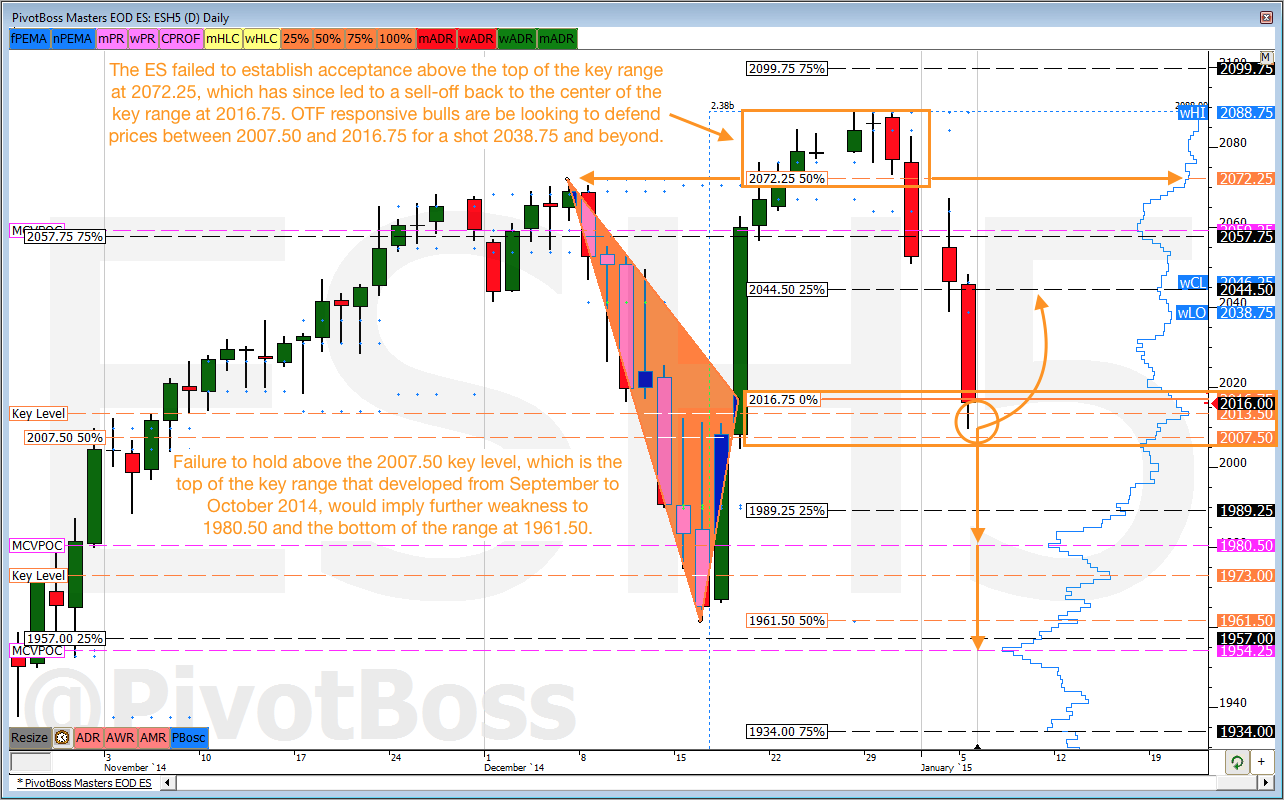

Taking a look at the daily timeframe of the ES, you’ll notice a key range developed in the month of December from 1961.50 to 2072.25. At the tail end of December, the ES pushed through the top of the range at 2072.50 and attempted to establish acceptance above it for a shot at further range expansion. However, after price held above the 2072.50 for five solid sessions, bulls failed to get paid and instead were forced to liquidate positions, which triggered the recent selling pressure into the center of the key range at 2016.75.

You see, any time price fails to establish acceptance beyond a high (or low) of a key range, the result is usually a reversal back toward the center of the range, with a good shot to see a full on reversal across the range to the opposite extreme. That’s exactly what’s happening in this instance. Bulls failed to get paid above 2072.50, and instead were forced to liquidate by selling their positions when price failed to hold above 72.50.

Now what? Will we see a continuation move to the bottom of the range at 1961.50, or will price rally back toward prior highs at 2072.50?

Key Support from 2007.50 to 2016.75

Given the long term trending structure of the market, OTF responsive bulls are eager to defend major pullbacks for a shot at new highs into 2100.

As of right now, bulls are in the early stages of defending a key zone from 2007.50 to 2016.75, which represents a confluence of market-generated key levels, including the center of the key range at 2016.75 and the top of the September to October range at 2007.50. This is the initial zone of support that bulls are defending for a shot at returning price to the previous week’s closing price of 2038.75, and perhaps higher into the previous MCVPOC at 2059.25.

Keep in mind, failure to hold above 2007.50 suggests further downside price discovery to the next HVN below at 1980.50 and the bottom of the range at 1961.50. If this turns out to be the case, then look for price to run stops through the previous low of 1961.50 and into CVPOC at 1954.25.

Try PivotBoss Premium for 2 Weeks!

I’m very excited to announce that you can now take PivotBoss Premium for a spin with our new 2-Week Trial Offer!

I can honestly say that I’ve put a lot into Premium over the last year to create a robust library of analysis, charts, and education for our Members — and the results have been stunning!

Want more details? Visit http://pivotboss.com/trialoffer/

Cheers!

Frank Ochoa

Author, Secrets of a Pivot Boss

PivotBoss | Own the Market

PivotBoss Premium | Premiere Analysis for Traders

PivotBoss Masters | Premiere Training for Traders

______________________

Start Your 2-Week Trial to Premium Today!