Our recent 30-point winning trade recommendation in Gold futures brought about a lot of “high fives” among PivotBoss Premium members this week, but also introduced questions of “how would you enter this trade?” by those becoming familiar with our calls.

As such, I wanted to take some time to provide some actionable ideas for successfully executing a swing trade with our PivotBoss Premium analysis.

First, let’s start with the analysis…

Premium Analysis

For the most part, our Sunday evening video analysis provides our earliest swing trading ideas for the upcoming week. If you don’t have a current position in the market, be sure to watch our Sunday evening video analysis for each market for potential swing trade ideas for the week ahead.

I generally provide one bull and one bear trade recommendation, with entries and targets for each market, while also providing my “primary trade idea”. These trade recommendations are then updated throughout the week via videos and annotated charts (playbooks), as new price and volume information enters the market .

Video Analysis

Here’s the 90-second video that I provided our Premium Members Sunday evening on April 5, 2015, which turned out to be worth $3000 over the course of the following 4 days. In the video I spell out the primary bear trade recommendation for the upcoming week for Gold futures, which includes the following: “Look for a continuation into 1224. If you’re a bear, look to defend 1224s for a shot at 1186 to 1190.”

Playbook Analysis

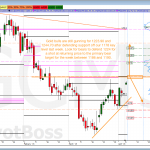

After the videos are posted, I then post the same trade recommendations directly onto an annotated chart, which I call a playbook, which helps you visualize how the trades could turn out.

Here’s a few of our recent Playbooks that were posted for Gold futures, with regards to the recent trade recommendation.

- The first playbook was posted April 1, 2015, and gave our Premium Members advanced warning to watch the 1220-1225 zone for a selling opportunity in Gold futures.

- The second playbook was posted April 5, 2015 just minutes after the video from above was posted, and reiterates the 1224 level as the one to defend for bears.

- The third playbook was posted after the close on April 6, 2015, and updates our Premium Members of our the primary bear target of 1193.70, which is part of our PivotBoss proprietary ADR Method tools.

- The last playbook celebrates a successful trade recommendation for Gold futures – a 30-point move in just 4 days worth $3000 per contract traded!

Executing a Successful Swing Trade

Now that you have a better understanding of how we offer trade ideas via our Premium analysis, we’ll now delve into executing a successful swing trade.

In my opinion, any time you execute a trade according to your trading plan, which includes a pre-meditated trade management approach, you’ve essentially executed a successful trade, regardless if the trade wins or losses money.

Having said that, I want all Premium members to keep trade and risk management at the forefront of your trading plan whenever you’re considering executing any trade — especially those that I recommend via Premium.

If you’re looking to adopt a new trade management approach, then you’re in luck, because I’m about to give you one of my favorite trade management techniques that anyone can use, from investors to scalpers!

The 11 Scaling Technique (AKA The Free Trade Technique)

The 11 Scaling Technique is a 2-part trade management technique that is designed to reduce your risk in a trade by scaling out of half of the position immediately upon reaching your first, pre-determined target, which is equidistant to the initial stop loss of the trade. Once the first scaling target has been reached and you’ve successfully scaled half of the position, keep the same stop loss in place for the last half of the trade, and you essentially have a completely “free trade”, less commissions.

The Free Trade Technique can be applied to any timeframe for any instrument. You can use it for swing trading ETFs, investing in stocks, and scalping E-Minis. Essentially, the 11 Scaling Technique is:

- Designed to quickly eliminate the risk in a trade

- Designed to book consistent profits

- Designed to improve your consistency

- Designed to preserve emotional capital

Any time you’re considering trading one of my recommendations, at the very least use the 11 Scaling Technique. It’ll reduce your risk, improve your consistency, and save your bacon.

Defining Your Risk

Before you actually execute any trade, you must first define your risk. How much are you willing to risk on this trade? In our Gold example, my initial forecast projected a move of about 34 to 38 points in Gold for the upcoming 5 sessions, which amounts to a profit potential of $3400-3,800 per contract traded from our sell level of 1224.

Let’s say we want to risk $400 for this swing trade, which gives us a nice Reward:Risk ratio of 8.5:1.

With any scaling trade management approach, you must trade with more than one contract. Since the 11 Scaling Technique is a 2-part trade management technique, we must trade a number of contracts that is divisible by 2. Therefore, you could trade as little as 1 contract per scale, or you could trade upwards of 100 contracts per scale…that’s what makes this approach so powerful — it’s scalable!

Let’s use 2 contracts to keep things simple. Gold trades at $100 per point, which is $10 per tick. So if we want to risk $400 for this trade using 2 contracts, we’re essentially risking $200 per contract traded, which gives us a 2-point maximum stop loss for our trade.

Planning the Trade

Now that we know our initial risk and the size of our stop, we can now plan our swing trade. Here’s our current plan:

- Trade Idea: Fade the 1224 CLVN in Gold for a return to the primary weekly bear target

- Entry: Submit a Limit Order to sell 2 contracts of GCM5 at 1224

- Stop Loss: Submit a Stop Order to buy 2 contracts of GCM5 at 1226

- Stopped: Losses $400 if triggered before first scale

- Free Trade: Trade breaks even if triggered after first scale

- First Scale: Scale 1 contract at 1222 using a Limit Order to buy 1 contract, which books a 2-point winner (+$200)

- Free Trade: Trade breaks even after reaching the first scale

- Keep original stop for final scale, but resubmit Stop Order to buy 1226 with just 1 contract

- Final Scale: Cover last contract at primary weekly bear target at 1193.70 using a Limit Order to buy the last 1 contract, which books a 30-point winner (+$3030)

- Final Tally: This trade risks $400 to make a potential return of $3,230 (8:1 reward:risk)

Write this plan on a sheet of paper before you execute your trade, and refer back to it throughout the trade management portion of your trade for execution purposes. By doing this, you become akin to a machine merely executing a plan, which helps to remove the emotion from trading.

Now, it’s all about execution. Just follow the if, then, and else’s in your trade plan!

Executing the Entry

When it’s time to execute, it’s best to follow the script (your handwritten trading plan) and submit the orders. Let the market come to you.

Here’s how the execution of the entry and the first scale would have played out for this Gold recommendation using the 11 Scaling Technique:

What’s great about this approach is it gets you to breakeven very quickly, which frees your time and your mind to find other opportunities.

In the case above, it took a mere 30 minutes after entry to get this trade to a breakeven proposition. From there, you can just let it coast toward its intended target. If it reaches the target, you win big. If it doesn’t…you lose nothing. That’s hard to beat!

What If I Don’t Trade Futures?

Don’t worry if you don’t trade futures! You can use my futures analysis to trade ETFs or stocks that correlate with the market I’m referencing.

Don’t worry if you don’t trade futures! You can use my futures analysis to trade ETFs or stocks that correlate with the market I’m referencing.

For example, that same 30-point move that I called in Gold futures translated to a 3-point sell-off in the underlying ETF GLD! Likewise, this analysis could have given you a heads up that stocks in the Gold industry group were ripe for a turn.

Success Starts With Risk Management

As I mentioned before, executing a successful swing trade is more about executing a pre-meditated trade management plan for your trading idea. If you do this, your trade should be considered successful, regardless of the monetary outcome.

The goal is alway to scale early to reduce, or completely eliminate, risk in your position. Do this every time, and I promise you’ll increase your odds of a long and prosperous trading career.

Cheers!

Frank Ochoa

Author, Secrets of a Pivot Boss

PivotBoss | Own the Market

PivotBoss Premium | Premiere Analysis for Traders

PivotBoss Masters | Premiere Training for Traders

______________________

Start Your 2-Week Trial to Premium Today!