United States Natural Gas Fund ($UNG) has traded within an extremely tight range over the last two to three days, paving the way for potentially big breakout opportunity. Let’s take a look!

Tight Range

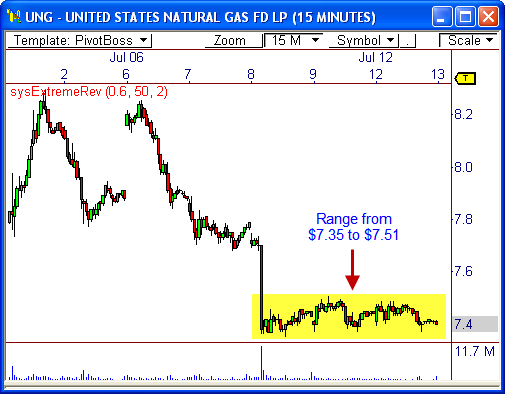

$UNG, the ETF for Natural Gas, dropped throughout most of last week’s trading action. However, toward the tail end of the week, price traded within a very tight range – which has spilled over into the current week.

The range spans from $7.35 to $7.51. After this period of contraction, we will likely see a period of range expansion. Keep an eye on the boundaries of the range for breakout confirmation.

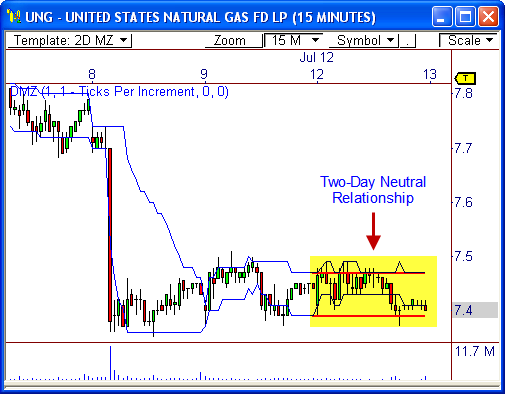

Two-Day Neutral Relationship

The Money Zone levels show $UNG has formed a two-day Neutral relationship, which usually precedes a breakout opportunity.

A Neutral relationship occurs when the value area remains virtually unchanged from one day to the next, meaning that market participants are happily trading within the current price zone due to a fair facilitation of trade.

However, this relationship usually paves the way for a breakout, since traders will begin to push price toward a new area of perceived value.

If price gets an open that is beyond range and value, we could see a very nice trending environment ahead for this stock. Either way, a breakout could prove to be very profitable.

Watch $7.35 and $7.51 closely.

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss