The market is clearly winding up for a major breakout opportunity, as evidenced by the 1,000 point triangle that’s building out in the $DJI. I’ve got three stocks to watch that are poised to move once direction is decided.

1. $CME

$CME has dropped 40 points since I wrote the entry “3 Reasons to Sell $CME” last month. Now, $CME is holding at the critical support level of $264, which also has double-pivot confluence.

Both the S1 and L4 support levels are sitting on visual support, which means it’s going to take another round of strong initiative selling to push price through $264.

If $264 holds, expect a bounce back toward $294. Otherwise, a violation of support could send price spiraling to $220, which is the next significant area of support.

2. $NFLX

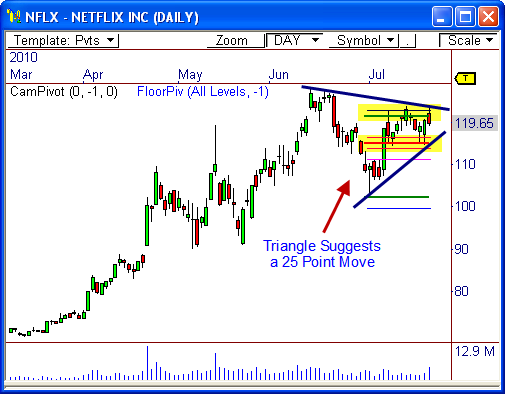

$NFLX has been extremely bullish over the last two years of trading, which has intensified the last six months.

Price is now coiling within a developing triangle pattern, which could spark the next 25 point move – as measured by the back end of the pattern.

An upside break would require a push through double-pivot resistance (R1 and H4) at $124, while a downside break must contend with double-pivot support (H3 and PP) at $114.

3. $AKAM

$AKAM is also developing a clear triangle pattern in the midst of a bullish advance. The back end of the pattern suggests a move of about 8 points once a breakout occurs.

The multiple moving average method indicates a PEMA Breakout could be developing in this stock, which means a breakout could be around the bend. Watch $45 and $41 for a confirmed breakout opportunity.

The market continues to build out ahead of a major breakout opportunity. Once direction is decided, these three stocks could be poised for big moves.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Pingback: $CME is Ready for Another Breakout | PivotBoss.com