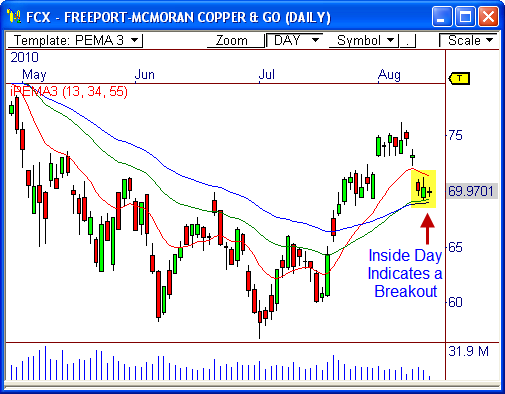

Freeport-McMoRan Copper & Gold ($FCX) is clearly winding up for the next major breakout opporunity, which could lead to the next 5-7 point move. Here’s why..

Inside Day Relationship

The daily chart of $FCX shows price has formed an Inside Day relationship, whereby Friday’s range occurred within the range of Thursday’s price activity. This type of formation usually leads to a big breakout opportunity.

Watch the outer boundaries of Friday’s market for early signs of a breakout today: $69.40 down, and $70.50 up.

Moving Average “Tweener”

Aside from the Inside Day relationship, the pivot-based moving averages also hint at a potential breakout, as well. Price has formed a three-day range in between two sets of moving averages, with the 13-period avearge above price and the 34- and 55-period averages below price.

This type of formation usually indicates price is winding up ahead of its next directional move. Price doesn’t usually remain in this state for long, however, a an eventual breakout usually occurs rather quickly.

Again, watch the boundaries of the 3-day range for a confirmed breakout opportunity ahead: $69.10 down, and $71.40 up.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss