American Eagle Outfitters ($AEO) has been extremely bearish over the last six months of trading, with price dropping from $19 to $12 during this time. As such, many of the recent rallies in this stock have been great selling opportunities. The recent advance is no different, as selling pressure could push price back toward $12.

Confluence of Weakness

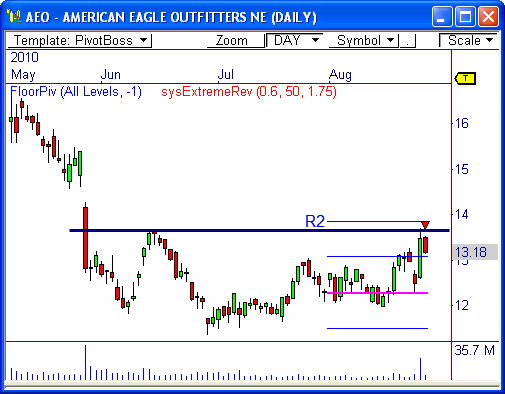

The daily chart of $AEO shows price has been stuck in a large trading range from $11.50 to $13.70 over the last three months. Each rally within the range has led to clear selling pressure, and the recent test at resistance indicates more of the same.

Price is showing exhaustion after testing resistance at $13.70, which could lead to another dose of weakness back toward the month’s support at $12. The last time price dropped from this zone, new lows were seen below $12.

Price also reversed just shy of the important R2 resistance level and has also formed a highly bearish Extreme Reversal pattern (the short signal), which occurs when price is over-extended and snaps back in the direction from whence it came.

If $AEO cannot rise above $13.80, look for another drop back toward $12, with a pit stop at $12.25.

But what do I know? I’m drinking a frosty beer right now…look out!

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss