The S&P 500 Index ($SPX) has developed several major technical patterns over the last few months that many traders will be watching closely in the weeks to come. Important directional clues could be revealed by these patterns ahead. Take a look..

I hope you all had a wonderful Labor Day! It’s time to get this holiday-shortened trading week underway!

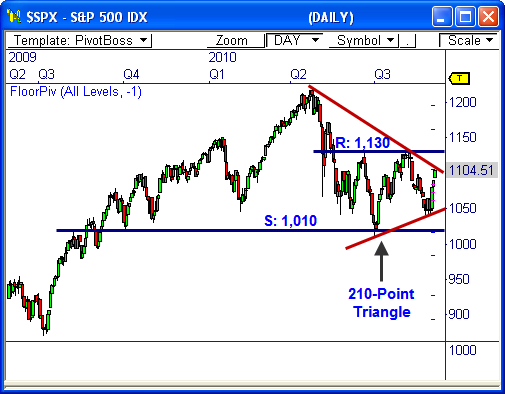

Developing Triangle

The $SPX is sitting right at the upper trend line of the a large, developing triangle pattern, which has built out over the last five months. This pattern has a back end of 210 points, which means an eventual breakout could spark the next 210 point move in the direction of the break.

The 1,105 level will be the zone to watch for an initial breakout this week, although this level also coincides with monthly R1 resistance. A confirmed breakout would be seen upon a break through the recent price-based pivot at 1,130.

If 1,105 cannot be breached, look for a retracement back toward the center of the range, as further development occurs. Eventually, this triangle could pave the way for the next major trend in this index, similar to the move that occured from Feb-April of this year.

Major Support and Resistance

The index has developed extremely clear support and resistance levels over the last year of trading. Right now, 1,130 resistance remains the biggest overhead resistance level to watch, as this zone rejected price twice in the last three months. If 1,105 is crossed, we could see another try at 1,130 ahead, which could pave the way to new highs for the year.

Of course, critical support remains the 1,010 level, which has held many times over the last year of trading. This is the last line of defense for the bulls and has led to several important bounces during this time.

If this level is broken, a major shift in trend could offer for this index. Since this line remains intact, the 18-month uptrend remains in effect.

Large Head-and-Shoulders Pattern

The 1,010 support level also doubles as the neck line of a huge H&S pattern. Obviously, this type of pattern is very bearish, but a solid violation is needed. A violation also forecasts a 210 point move from the breakout point of the neck line, so we could be looking at a target back at 900.

However, when the entire market sees an H&S pattern, there is a tendency for the pattern to produce false breakouts. Therefore, this pattern could ultimately spark the next major reaction rally if 1,000 is taken out.

Continue to watch these major technical levels very closely, as they could help us snuff out major directional cues ahead.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss