Progressive Corp. ($PGR) took a turn for the worse yesterday, as price had one of its biggest one-day declines of the summer. As it turns out, the $21 resistance level is more solid than you may realize. Here’s why..

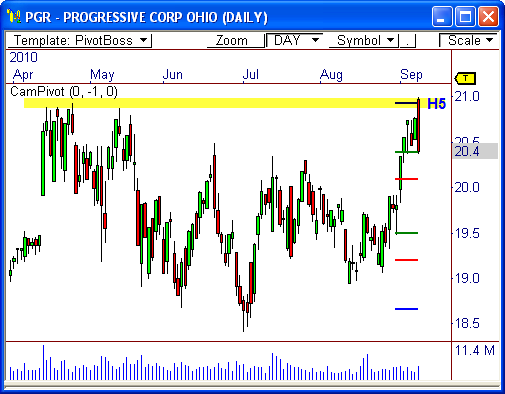

Daily Resistance

Progressive Corp. reacted to the clear $21 resistance level in the daily timeframe, which has held firmly the last six months. As a matter of fact, the H5 Camarilla pivot level also coincides with this visual resistance level, thus creating a nice zone of confluence.

The fact that price reacted sharply to this area of resistance (forming a highly bearish Engulfing candlestick) indicates another wave of weakness back toward prior support could be seen, which currently resides from $18.65 to $19.00.

If price cannot break through the $21 level, look for another drop to support ahead.

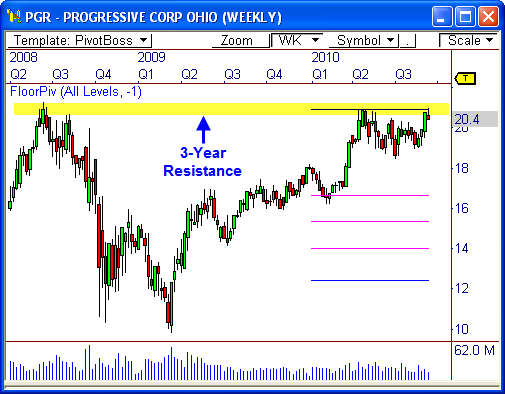

Weekly Resistance

More impressively, the weekly chart of $PGR shows the $21 level has actually held for three years! Adding further relevance to this visual resistance level is the yearly R1 resistance level at $20.89, which solidifies this level as critical resistance.

Price is going to move away from this level in rapid fashion once direction is decided. An upside break could unleash a rally back toward $25.50, while a downside reversal could lead price back toward $16.75. The $21 level remains the key. Watch it closely.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss