The Russell 2000 Index ($RUT) fell asleep at the wheel last week, but developed an incredibly tight 4-day range in the process. This range could pave the way to the next major breakout opportunity ahead. Here’s why..

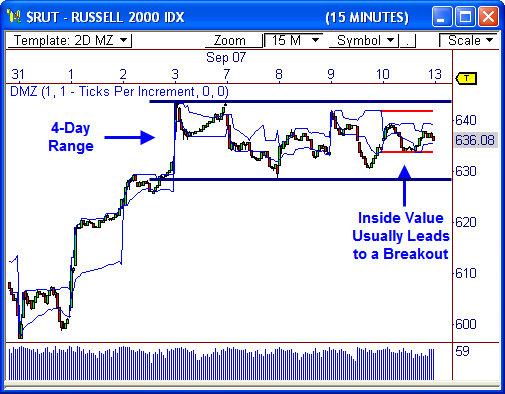

Inside Value

The 15-minute chart of the $RUT shows the 4-day range that has developed from 628.5 to 644.00, with the range tightening toward the tail end of the week. The fact that this range/consolidation has formed after the recent rally from support at 588 indicates another round of strength ahead. As a matter of fact, an upside break could very well push price back toward major resistance at 672.

The 15-minute view also shows that an Inside Value situation has developed, whereby today’s value area is inside the value area from Friday’s market. This relationship usually leads to a breakout opportunity, but must be confirmed by price breaking free from the current range.

A breakout from the current price range (644 up, and 628.50 down) will likely spark the next key wave of trending price movement. Watch 630 and 640 for early breakout cues.

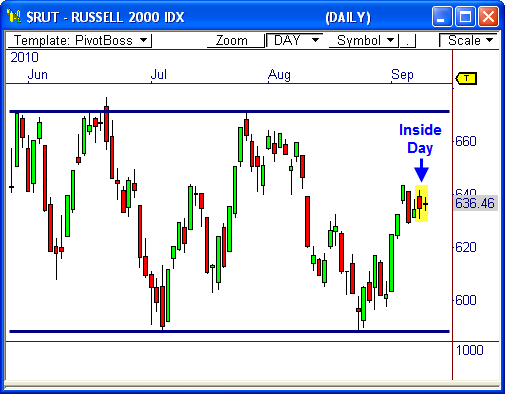

Inside Day

The daily timeframe shows that price has also developed an Inside Day relationship, which occurs when the current day’s price range is inside the price range from the prior session. This type of relationship also has the potential to spark a big breakout session.

A breakout from Friday’s range could trigger a nice breakout ahead, so watch 640 up, and 633 down.

Keep in mind, a breakout today could lead to trending movement throughout the session, which could influence price the rest of the week.

I’m looking forward to a big week – let’s see if we get one!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss