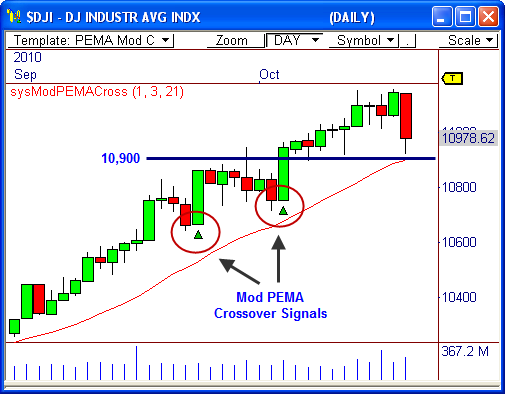

Every pull-back in the $DJI has been a major buying opportunity during the current two-month rally. Given yesterday’s decline, we could see another round of strength enter the market soon.

Modified PEMA Crossover

Buying the dips and selling the rips are a great way to play the market during established trends. The Dow has formed a great two-month bull trend and continues to honor the 21-period pivot-based EMA, making every pull-back above this EMA a nice buying opportunity.

If price holds above 10,900 and closes positive, the Modified PEMA Crossover system could fire a buy signal by the end of the session – which could lead to another round of strength to new highs above 11,160. This would be similar to what was seen the last two times signals were fired during this trend.

You can learn more about the Modified PEMA Crossover system in my FREE eBook Profiting with Pivot-Based Moving Averages.

10,900

The 10,900 level is the fulcrum to watch for medium term direction. Price has held above this zone nicely throughout much of October. However, a close below this level could spark a wider retracement ahead. The last three times this level was tested, buyers immediately entered the market. Let’s see if it continues to be the case.

A break back above 11,000 could be a nice play back toward 11,160 today.

Let’s see how this plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss