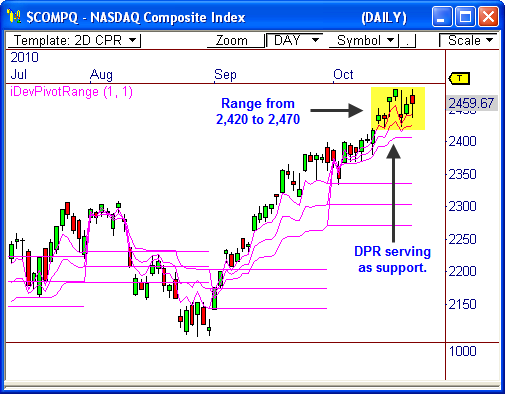

The NASDAQ Composite Index ($COMPQ) has been extremely bullish since the tail end of August and has rallied from 2,100 to 2,470 during this time. The index remains strong and should continue to push higher should 2,400 remain intact.

Developing Pivot Range

The daily chart shows price has been trending steadily higher above the monthly pivot ranges from September and October. However, price has also remained above the dynamically updating developing pivot range during this time, as well – which is quite bullish.

As it currently stands, the NASDAQ should remain bullish as long as it can continue to hold above the bottom of the pivot range at around 2,400, which has been a clear line in the chart the last few weeks.

Notice that every test at the developing pivot range has been a buying opportunity during the recent trend. This pattern is likely to remain true until price closes below the pivot range, so watch 2,400 closely.

You can read more about the developing pivot range indicator and how I use it in my book Secrets of a Pivot Boss. You’ll also gain access to the code, too!

Price Range

The NASDAQ is also forming a clear price range at highs from 2,420 to 2,470, which has developed over the last 7 trading sessions. This type of price behavior usually leads to more strength, so continue to watch 2,470 closely. If price closes beyond this level, we could see a sprint to the year’s high at 2,535.

Otherwise, a close below 2,420 could lead to a wider retracement in price.

Let’s see how this plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss