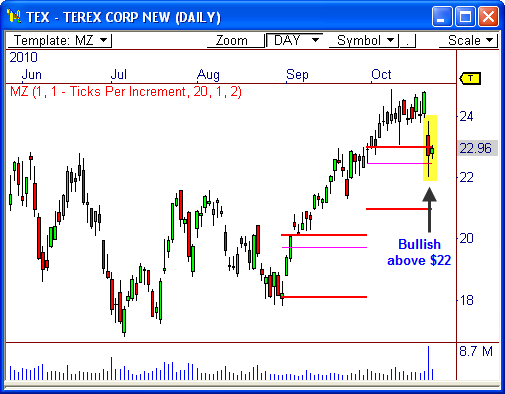

Up until two sessions ago, Terex Corp. ($TEX) had been a very bullish stock. However, the recent sell-off could lead to another round of strength ahead. Here’s why..

The Money Zone

A two-month Higher Value relationship has formed in $TEX, which is typically bullish, especially in trending stocks. Any pull-back to the value area during a trend should be seen as a bargain entry point.

$TEX is holding right at the monthly Point of Control and the Value Area High, which makes for a great area for buyers to enter the market. If price can hold above $22, we could see buyers push price back toward the October high of $25, or higher.

Otherwise, a failure below $22 could lead to more selling pressure back toward the Value Area Low at $21.

Inside Day Relationship

Since Friday was an extremely quiet trading session on most fronts, Inside Day relationships have formed at a higher rate than usual. This means that a major breakout/trending session could be seen.

An Inside Day relationship has formed in $TEX and could offer an excellent breakout opportunity for today’s session. Watch Friday’s range ($23.10 up, and $22.55 down) for an entry.

30% OFF!

For this week only, I’m discounting my book Secrets of a Pivot Boss by 30% – order for JUST $69.96!

For this week only, I’m discounting my book Secrets of a Pivot Boss by 30% – order for JUST $69.96!

If you’ve been waiting for an offer like this, the time is NOW! October 31st will be the last day you can cash in on this deal.

This offer is only valid at Shop.PivotBoss.com – and the book will be autographed!

Check it out! CLICK HERE!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss