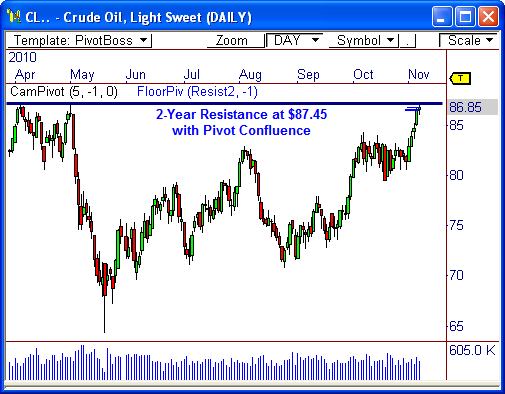

Crude Oil has been pushing quietly higher the last two months, but is now testing an extremely important resistance level at $87.45. How price reacts to this two-year resistance level could spark the next major wave of price movement.

Two-Year Resistance

Crude Oil has been banging against the $87.45 resistance level throughout the year, which is a level that has also held since October 2008. Each test at this level has led to heavy selling pressure in 2010. Will the same happen this time around?

The last time price dropped from this zone, we saw a decline to $64.24. However, if price were to decline this time around, I could see a more manageable target of $81.75 reached, with the potential to test as low as $75.

Pivot Confluence

Not only is visual resistance extremely clear, but there is also a confluence of pivot resistance, as well. The monthly R2 and H5 pivot levels from the Floor Pivots and Camarilla Pivots, respectively, are also sitting just beneath $87.45.

If price cannot break through this line of resistance, we could be looking at a sharp decline in the days ahead. Furthermore, the spinning top candlestick indicates a bit of uncertainty, or lack of confidence, which further paves the way to weakness.

I will continue to watch for confirmation, however, as breakout in either direction from Friday’s range could spark a solid week of trending activity. While a downside break allows for a clear target, an upside break has “clear air” above, which could allow for a more explosive move.

Let’s see how this plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss