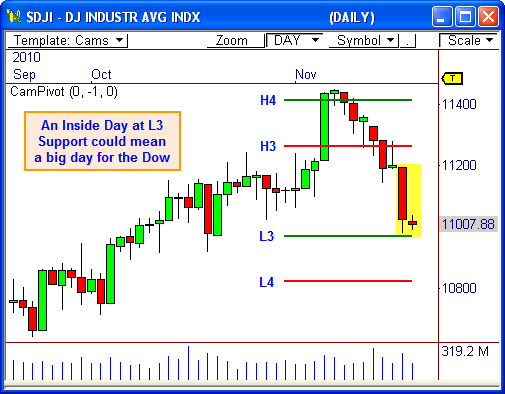

The Dow Jones Industrial Average ($DJI) has dropped steadily for two weeks after briefly topping 11,400 earlier in the month. However, the Dow is now sitting at a major line in the sand, which could provide the next important move for this index. Read More..

L3 Support

The Dow has honored important Camarilla pivot levels throughout the month of November; first rallying to the H4 pivot level at 11,415, before dropping to L3 support.

Now the index is taking a breather at L3 support ahead of the next major move.

If L3 continues to hold at 10,970, we could see a rally back toward 10,200. However, if L3 gives way, look for a downside continuation to L4 support at 10,825.

Inside Day

The Dow has also formed another Inside Day relationship, whereby yesterday’s price range is inside the price range from two days ago.

As you know all too well, Inside Days can lead to explosive breakouts in the market. Look no further than two days ago when I wrote “Breakout Day for the E-Mini NASDAQ 100”, which forecasted the breakout and trend day for the session.

Keep an eye on yesterday’s range (11,045 up, and 10,990 down) for a decisive breakout. If price opens the session with initiative buying or selling beyond this range, we could see a very nice breakout/trend day on our hands.

FREE Webinar!

TTTHedge.com will be hosting a FREE Webinar event with me as their guest presenter!

TTTHedge.com will be hosting a FREE Webinar event with me as their guest presenter!

I’ll be looking at what’s to come for the market in 2010 and 2011, including the major market indexes and key futures contracts, and I’ll also provide a few stocks to watch!

The folks at TTTHedge.com are a great group of traders with a proven track record of success – and they know how to host an event!

The party starts at 12:00PM ET (Thursday Novemeber 18th).

Click the following link and sign on as a guest! http://ttthedge.acrobat.com/traders

I’m looking forward to seeing you there!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss