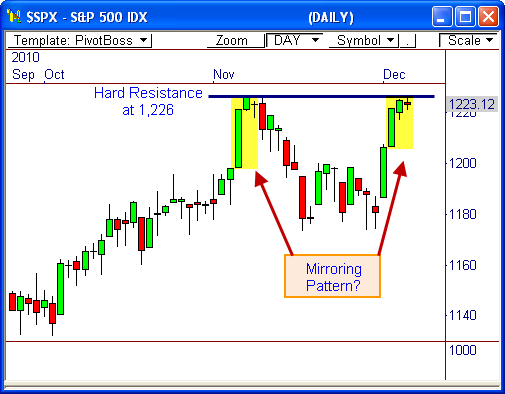

The S&P 500 Index has pushed higher from the 1,175 support level, but is beginning to show signs of resistance at 1,226. I have a few thoughts on what is likely to play out in this index in the days ahead…

Resistance at 1,226

The S&P 500 ($SPX) is testing a major area of resistance at 1,226, which held firmly in November and threatens to turn away the index again.

Taking a closer look at how the $SPX reacted to 1,226 in November reveals that price is beginning to mirror the price structure just prior to the 50-point drop. That is, price is forming a three-bar pattern that formed a month ago just prior to the sell-off that led to the test of 1,775.

Given this development, a violation of today’s low price of 1,220 could spark a steady sell-off back toward 1,200, if not lower.

Keep in mind, while short term weakness could be seen, the medium and long term strength of the market remains firmly intact.

The Not-So Inside Day

I like to define an Inside Day as a day that has both the high and low of the day that falls within the high and low of the prior session. That is, a daily range that falls within the daily range of the prior session.

However, some traders define an Inside Day as one where the open and close price are within the prior day’s open and close price, thereby ignoring the day’s high and low all together. Folks, that’s what we have today…a not-so Inside Day. Either way, this formation can still yield powerful results.

A breakout in either direction from today’s range could spark a trend day scenario for this index, which means big movement ahead.

Watch 1,226 and 1,220 for a decisive breakout opportunity tomorrow, as initiative market participants are likely to enter the market in the direction of the break.

Let’s see how this puppy plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss