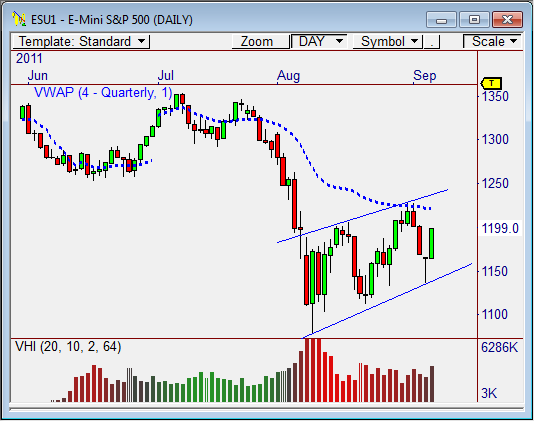

The E-Mini S&P 500 has traded within the boundaries of a developing channel over the last four weeks, creating great levels for trading. Does this pattern forecast more upside?

Channel

The daily chart of the E-Mini S&P 500 shows a well-defined channel that has formed over the last month of trading, creating amazing reversal opportunities at the extremes of the pattern.

The upward sloping nature of the channel forecasts longer term weakness ahead. We’ll talk about that when we need to.

For now, the short term outlook is up, as another wave of strength is likely to be seen toward the top of the channel over the next day or two, likely toward the 1,230 to 1,245 zone.

Higher Value Relationship

Since the daily chart gives us a bullish bias, our game plan will be to look for Long entries during tomorrow’s market.

The 15-minute chart shows a Higher Value relationship using the Value Area and developing Value Area indicators.

As you may recall, a Higher Value relationship indicates continued strength ahead, especially if price opens the session above the Value Area low (VAL), which will be 1181.50 tomorrow.

If price opens above this zone, the idea is to buy into any morning weakness, with the goal of reaching a new high within the three-day upmove. Essentially, we’re looking to buy the dip during this bullish phase.

Buy into any weakness between 1,181.50 and 1,194. I know this is a wide range, but we need to see how the open plays out in order to narrow it down a bit.

Keep in mind, if you get a solid entry, this play could turn into a two-day move that reaches 1,230 (or higher) for you swing traders.

Contingency

If price opens the session with a large gap down, below the 1,181.50 zone, the deal is off.

This would indicate that market sentiment has drastically shifted overnight and opens the door to additional selling pressure.

In this case, look to sell into any strength up toward 1,190.

**Don’t forget, tomorrow is E-Mini contract rollover day. We move to the December contract (Z).

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss