The E-Mini S&P 500 has been a great intraday mover this week, with moves easily spanning 10, 15, and even 20 points a pop. Here’s the key levels I’ll be watching tomorrow, along with the levels for all E-Mini’s..

Lower Value Relationship

The 5-minute chart of the E-Mini S&P 500 shows price tested VAL at the beginning of the day at 1,178.50 and was immediately met with selling pressure. This reversal paved the way for a steady decline the rest of the session, which sets up our game plan for tomorrow’s market.

The ES has formed a Lower Value relationship for tomorrow’s market, which is the most bearish relationship. If price opens below 1,155, we could see a nice opportunity to sell into morning strength, which could lead to a new three-day low.

The Game Plan

Our game plan for tomorrow is to sell morning strength for a shot at a new three-day low.

If price opens the session below 1,155, look to sell between 1,157.25 and 1,161.50, with a target set to the naked POC of 1,139.25. You can take an early scale at 1,145, and also play to a longer term target of between 1,126.50 and 1,130.

If price opens the session above above 1,170, this could indicate a change in sentiment, which could lead to a morning rally. If this is the case, look to buy into weakness between 1,161 and 1,166.25, with targets at 1,178 and 1,183.

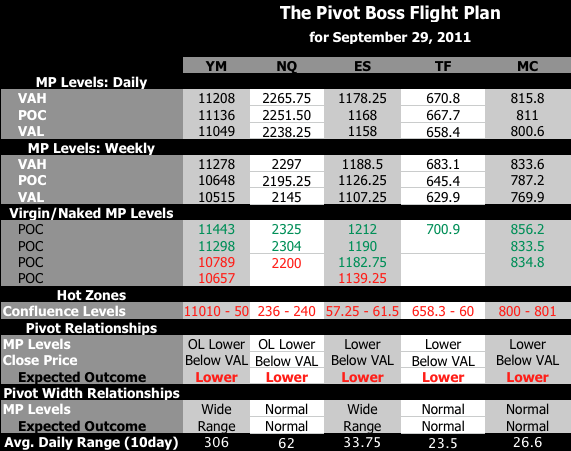

Key Levels for the E-Mini’s

Here’s a look at my key levels for the five E-Mini’s for tomorrow’s market:

Listen to My Interview!

I recently discussed trading with Tim Bourquin of TraderInterviews.com. You can listen to my interview (or read the transcript) FREE by visiting:

http://www.traderinterviews.com/links/FrankOchoa

Bookmark it and pass it along to your friends! Oh, and feel free to make fun of my Texas accent!

Let’s see how the ES plays out tomorrow!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss