Crude Oil has been on a bullish tear since forming a double-bottom and rallying off the $75 level in early October. Since then, Crude has reached $110, and could be headed higher. Here’s why..

Pivot Range Support

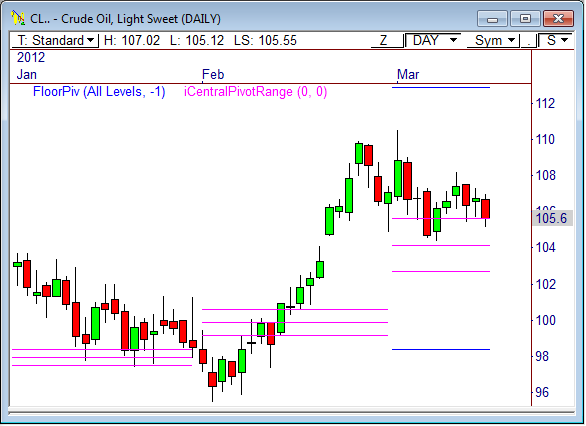

After February’s bull trend, Crude has been in a somewhat stale “holding pattern” through the first two weeks of March. However, this holding pattern could boost price higher in the weeks to come.

The daily chart shows price has held at the monthly pivot range throughout the month, which has formed a two-month Higher Value relationship – the most bullish value area relationship.

If Crude continues to hold above the monthly pivot range at $102.68, or even the monthly pivot point at $104.17, we could see another round of buying pressure that pushes Crude to new highs within the current bull trend, likely to the monthly R1 pivot at $112.86.

A push to the R1 pivot would also coincide with prior highs of 2011, which span from $113 to $114.85.

Buying Opportunity

Given recent strength in this commodity, a buying opportunity could be seen should price drop between $103.50 and $105, with an upside target in the $112 to $113 zone. However, a violation of the $103.50 level could lead to downside price discovery toward the $100 zone, so watch this level closely as a fulcrum.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow Frank on Twitter: http://twitter.com/PivotBoss