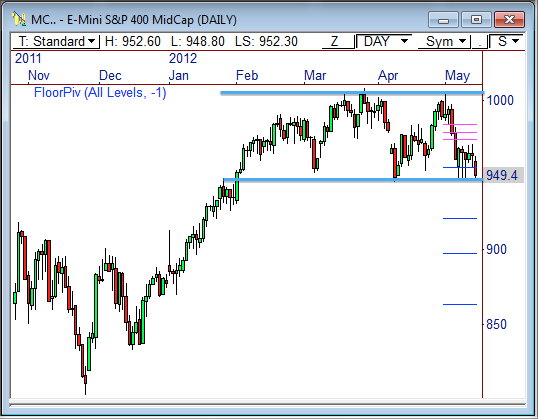

The E-Mini S&P 400 futures contract has been range bound the last three months, but that could change should 945 give way.

Trading Range

The daily chart of the MC futures contract shows price has traded within a clear trading range since February, as a shift from expansion to contraction was seen.

Price has established very clear levels of both support and resistance, which span from 945 to 1,010. Responsive buyers and sellers have been quite active at these levels, which have kept prices within range, but a breakout could be near.

The fact that this trading range has formed at the highs of recent advance is generally bullish – at least longer term.

Resistance

However, this contract has rallied 150% since the 2009 bottom and has had trouble crossing the 1,000 to 1,020 band of resistance over the last year of trading, which could put a damper on current strength in the near term.

If this resistance level can be taken out, we could see a major release of energy to the upside in the months ahead, so keep this area of resistance in your sights.

Support

For now, we’ll have to watch the 945 support level very closely, as a violation could easily lead to continued weakness. Such a break could spark initiative selling pressure, which brings various downside levels into play, namely 920, 900, and 875.

Responsive buyers have maintained control at 945 so far, but the battle lines are clearly drawn.

Let’s see how this one plays out!

I’m in Dallas Tonight!

I’ll be speaking at the Association for Technical Analysis (AfTA) meeting tonight in Dallas! Come see me!

I’m delivering two presentations – one that is FREE to the public, and one that is for AfTA members only. Guests can also attend the members-only presentation for just $25.

You can read more about the event at my website HERE and on the AfTA website HERE.

I’m looking forward to seeing you there!

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow Frank on Twitter: http://twitter.com/PivotBoss