Starwood Hotels & Resorts (HOT) is testing significant resistance, and could be on the verge of a major move ahead. Here’s why…

Resistance at $61

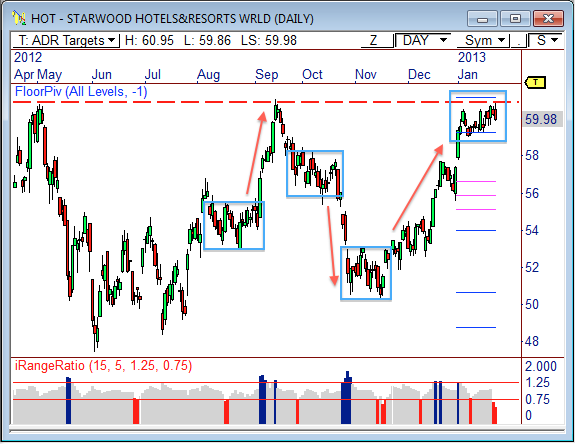

The daily chart shows HOT is currently testing a significant area of resistance at the $61 level. As a matter of fact, this level has been resistance for two years, and every test at this level has led to several stern rejections.

The daily chart shows HOT is currently testing a significant area of resistance at the $61 level. As a matter of fact, this level has been resistance for two years, and every test at this level has led to several stern rejections.

In 2012, the average move away from the $61 level was 20%, so we could be on the verge of a similar move very soon.

Also, it’s interesting to note that the monthly R2 Floor Pivot sits right at $61.12, providing a solid confluence of resistance. Clearly, a breakout or reversal away from this level could lead to some exciting price action.

Compression

Over the last two years, every reversal away from the $61 level has been swift and sharp, similar to v-bottom reversals.

However, this is not the case this time around, as HOT has been trading within a highly compressed trading range below $61 for the last 15 sessions.

In my opinion, this compression could signal an even bigger move ahead, regardless of direction.

The Range Ratio indicator shows the average 15-day price range is significantly smaller than usual, as evidenced by two consecutive readings below 0.75. Readings below 0.75 usually signal impending breakouts, so watch the outer boundaries of the 15-day trading range for a confirmed move.

For reference, I’ve marked similar ranges from the last few months that have yielded great results.

The Game Plan

Thursday’s bearish Outside Day reversal candlestick pattern hints at a sell-off ahead. However, a break back below the monthly R1 pivot and through the bottom of the 15-day range at $58.95 will confirm selling pressure. Here are the bear targets to watch: $56, $54, and $52.

On the bull side, watch $61.15 for signs of strength. A break beyond this level could spark initiative buying participation, which could pave the way for big strength ahead. Here are the bull targets to watch: $64.50, $65.50, and $66.35.

Keep in mind, price will likely continue to build out within the boundaries of the tight range until a decisive breakout occurs. Be patient, and ready.

Let’s see how this one plays out!

Swing Trade Pro

Don’t forget, Friday is the last day to order the 3-disc DVD set of Swing Trade Pro, with the chance of receiving two additional live educational trading webinars that complement the training.

Don’t forget, Friday is the last day to order the 3-disc DVD set of Swing Trade Pro, with the chance of receiving two additional live educational trading webinars that complement the training.

I’ve received an immense response from traders all over the world, so be sure to take advantage of the bonus offer!

CLICK HERE TO READ MORE ABOUT THE COURSE

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow us on Twitter: http://twitter.com/PivotBoss

[cc_h_line color=”888888″]

[cc_list_posts post_type=”post” amount=”3″ img_position=”left”]

Glad you are talking about interesting stock plays.

Look at AEE. I think it is going to 38

But yet,remember when I said 14000 for the Dow.

neal