E-Mini S&P 500

The E-Mini S&P 500 had an impressive rally from Monday’s low last week, setting the stage for more upside in the months ahead. However, the bears still have a shot at regaining the upper hand in the medium term. Or, depending on how you look at it, the bulls have a lot of work to do before they can safely say that they control the trend.

There is a ton of overhead resistance in the ES right now, beginning at 1613 and rising up to 1650. Any advance within this zone could potentially lead to some erratic and volatile price behavior, as bulls and bears slug it out.

For now, as long as the bulls control 1550, continued strength is likely to occur. Keep an eye on 1595, as this could be the early level that tips the hand of the market.

For Today’s Market

In yesterday’s ES report I wrote, “the ES has formed a narrow pivot range and a tight trading range that could offer breakout potential in either direction. Watch 1615 for strength, with bull targets at 1623.75 and 1629.75. Also watch 1605 for weakness, with targets at 1602.50 and 1596.25.”

The ES opened the session with a downside break through the bottom of the tightly coiled range Friday morning and dropped right into the two bear targets noted above (1602.50 and 1596.25), capping off a great trade to begin the session. Price then put in a low on the day at 1594.25 and rallied back to 1610, where it then held as resistance throughout the session and into the weekend.

The ES is holding above short term support at 1595, which will be a key zone to watch for early directional conviction this week. If price continues to hold above this zone we could see another push toward a fill of the gap that was created the day after the Fed news. If price breaks through 1610 early in the session watch 1614.50 as resistance. A break beyond this zone could spark a fill of the gap at 1622.75.

If 1595 gives way as support, watch 1581.25 as the next gap that “needs” to be filled.

Keep an eye on today’s daily targets of 1609 and 1594.25, and also watch 1650.50 and 1546 as the initial targets for the week.

If price opens today’s session with a large gap beyond one of the primary daily targets below, take half of the day’s ADR and project it higher and lower from the day’s open price to identify short term bull and bear targets.

Watch these key economic reports for today’s price action:

8:00am CT: Final Manufacturing PMI

9:00am CT: ISM Manufacturing PMI

Here are the targets for the current session and the week ahead:

| PivotBoss ADR Targets for: E-Mini S&P 500 (ES) | |||||

| Jul 1, 2013 | |||||

| ADR (5) | ONH | ONL | AWR (10) | WH | WL |

| 21 | 1,610.00 | 1,593.25 | 68.25 | 1,599.25 | 1,599.25 |

| DAILY TARGETS | WEEKLY TARGETS | ||||

| BULL | BEAR | BULL | BEAR | ||

| 1,603.75 | 1,599.50 | 1,650.44 | 1,548.06 | ||

| 1,609.00 | 1,594.25 | 1,667.50 | 1,531.00 | ||

| 1,614.25 | 1,589.00 | ||||

| 1,619.50 | 1,583.75 | ||||

| *BOLD indicates primary objectives | |||||

E-Mini NASDAQ 100

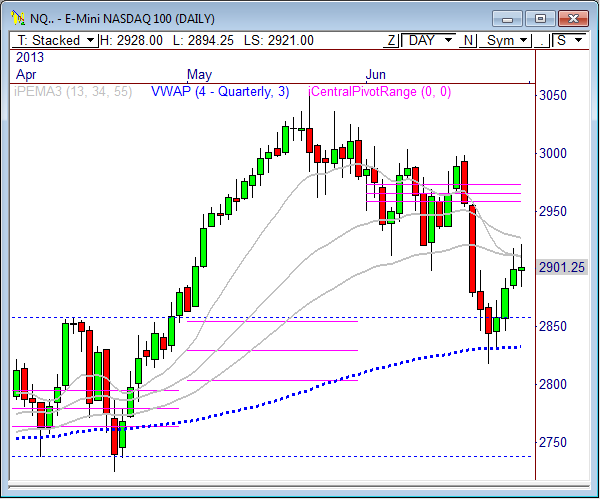

In Friday’s NQ report I wrote, “The daily chart now shows the NQ is testing a very thick zone of resistance between 2908.25 and 2931, which offers both PEMA moving average resistance and macro Fib confluence.”

The E-Mini NASDAQ 100 continues to hold between delicate zones of confluence above and below current price. Early last week, the NQ dropped right into a major zone of bullish confluence between 2817.75 and 2835 and rallied into the close of the week. Now, the NQ is testing a bearish zone of confluence above price between 2908.25 and 2931. It seems that a breakout from last week’s price range could dictate the next major swing move in this contract.

Longer term, it seems more overall strength is ahead, but price needs to be able to hold some key downside levels should tests occur. For now, watch 2885 as a fulcrum: long above, short below. If price fails sharply off the 2931 level, we could see a test 2885 support very soon. While a break above 2931 opens the door to the initial swing bull target of 2996.75.

Like the ES above, if price opens today’s session with a large gap beyond one of the primary daily targets below, take half of the day’s ADR and project it higher and lower from the day’s open price to identify short term bull and bear targets.

Here are the targets for the current session and the week ahead:

| PivotBoss ADR Targets for: E-Mini NASDAQ 100 (NQ) | |||||

| Jul 1, 2013 | |||||

| ADR (5) | ONH | ONL | AWR (10) | WH | WL |

| 34 | 2,928.00 | 2,894.25 | 127.50 | 2,901.25 | 2,901.25 |

| DAILY TARGETS | WEEKLY TARGETS | ||||

| BULL | BEAR | BULL | BEAR | ||

| 2,911.25 | 2,911.00 | 2,996.88 | 2,805.63 | ||

| 2,919.75 | 2,902.50 | 3,028.75 | 2,773.75 | ||

| 2,928.25 | 2,894.00 | ||||

| 2,936.75 | 2,885.50 | ||||

| *BOLD indicates primary objectives | |||||

Crude Oil

In Friday’s Crude report I wrote, “Keep in mind, since Crude had a wide price range in Thursday’s market, we could see a smaller range of movement today, so also watch 97.56 as a short term bull target, and 96.82 as the short term bear target.”

Crude Oil had big days on Wednesday and Thursday of last week, so the thinking heading into Friday was that price would likely trade in a more quiet fashion, as the market digests the recent price activity. That line of thinking was spot on, and the shorter term targets mentioned above were both hit during Friday’s session, with the bull target being just shy of the high of the session.

The line in the sand for Monday’s market will continue to be the 96 level. This level held as resistance last week before the breakout led to a test near 98. Price reversed to retest 96 in overnight trading and held it perfectly for a rally back toward 97.25, where it currently stands.

If price continues to hold above 96, we could see a test of prior highs at 99.01 very soon, which is the next key overhead resistance zone. A break of 96 opens the door to another test at 95, and potentially lower.

The monthly pivot range for July spans from 95.14 to 96.07, with the central pivot at 95.61. Guess where the current overnight low is? (A: the top of the monthly pivot range at 96.07) We could see price drop into this range for any early test this morning. If prices are defended, we are headed higher. If not, we could see prices back below 94.

Watch today’s daily bull and bear targets: 97.55 and 95.82. Also, the initial forecast for the weekly targets are 100.38 and 92.74, which I will update once Monday’s range is in.

Here are the targets for the current session and the week ahead:

| PivotBoss ADR Targets for: Crude Oil (CL) | |||||

| Jul 1, 2013 | |||||

| ADR (5) | ONH | ONL | AWR (10) | WH | WL |

| 1.97 | 97.30 | 96.07 | 5.09 | 96.56 | 96.56 |

| DAILY TARGETS | WEEKLY TARGETS | ||||

| BULL | BEAR | BULL | BEAR | ||

| 97.06 | 96.32 | 100.38 | 92.74 | ||

| 97.55 | 95.82 | 101.65 | 91.47 | ||

| 98.04 | 95.33 | ||||

| 98.53 | 94.84 | ||||

| *BOLD indicates primary objectives | |||||

Gold

In Friday’s Gold report I wrote, “Any retest of the prior support zone of 1220 to 1225 will likely be a selling opportunity…If price breaks back above 1225, we could see a brief relief rally back toward 1245.”

Gold opened Friday’s session with early strength and rallied back to the 1225 level, which was the level that gave way to the recent plunge below 1200. Gold prices held firm heading into the weekend and began heading higher Sunday night, reaching the 1247 resistance zone and topping out at 1247.40 in pre-market trading.

The 1247 to 1250 zone will be very important to begin the week. A valid push through this zone could spark more buying participation back toward 1270, where prices could meet heavy resistance. However, if price is not able to rise above 1250, we could see another drop to 1210 to 1220 for a retest before the next attempt to head higher.

Keep an eye on the primary daily bull target of 1254.70 and the bear target of 1216.80. Also, the initial forecast for the week’s swing targets are 1293.50 and 1153.90. Keep in mind, given last week’s wide range of movement, we could see a more moderate pace this week.

Here are the targets for the current session and the week ahead:

| PivotBoss ADR Targets for: Gold (GC) | |||||

| Jul 1, 2013 | |||||

| ADR (5) | ONH | ONL | AWR (10) | WH | WL |

| 40.78 | 1,247.40 | 1,224.10 | 93.04 | 1,223.70 | 1,223.70 |

| DAILY TARGETS | WEEKLY TARGETS | ||||

| BULL | BEAR | BULL | BEAR | ||

| 1,244.49 | 1,227.01 | 1,293.48 | 1,153.92 | ||

| 1,254.69 | 1,216.82 | 1,316.74 | 1,130.66 | ||

| 1,264.88 | 1,206.62 | ||||

| 1,275.08 | 1,196.43 | ||||

| *BOLD indicates primary objectives | |||||

Good luck and trade well.

Frank Ochoa

@PivotBoss