PB View

The market continues to remain bullish, with each pullback leading to a high-probability buying opportunity, as was the case during Tuesday’s market. The main level that I’ll be focusing on today is 3140 in the NQ, the E-Mini NASDAQ 100 futures contract.

If the NQ can push above 3140 and convert it to support, we could see a big wave of strength ahead. However, if this level is rejected, then 3100 could be around the corner.

The same can be said about the ES, as the 1697 level continues to be a major resistance zone in the ES. A break or rejection of this level will tell us a lot heading into the end of the week.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

From yesterday’s report, “if the ES drops into the 1682 to 1683 zone early in the day, you’ve got to consider buying with a shot at reaching 1696.”

The E-Mini S&P 500 futures opened the day with early weakness Tuesday morning, as expected, and dropped right into our 1682 to 1683 buy zone. Price tested the 1680 zone, and then formed a great bottom that led to a steady advance the rest of the session, coming within 6 ticks of hitting the 1696 target.

Price has slowly pulled back in overnight and pre-market trading, and is currently trading around the important 1687 price level, which offers a ton of confluence as a key level to watch. The 1687 level is the current composite VPOC for the recent trading range, which means there’s no real edge at the moment with price sitting on this level. However, if price can continue to hold above 1687, we could see another push into the 1694 to 1697 zone of resistance. Otherwise, the inability to hold 1687 forecasts another test at recent lows between 1679 and 1680.

The 1696 to 1697 zone of resistance has been incredibly strong, making this zone a clear area to watch for a break or rejection during Wednesday’s session. The current pre-market high of 1692.50 forecasts bear targets at 1682.75 and 1679.50, while the current pre-market low of 1685.25 suggests bull targets at 1691.75, 1695, and 1698.25.

Today’s scheduled economic news:

7:30am CT PPI m/m

7:30am CT Core PPI m/m

9:30am CT Crude Oil Inventories

12:20pm CT FOMC Member Bullard Speaks

2:15pm CT FOMC Member Bullard Speaks

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Wed, Aug 14, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,722.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 1,713.00 | Monthly H3 | 13.00 | 1,692.50 | 1,685.25 | |

| 1,705.00 | LVN | AWR (10) | WH | WL | |

| 1,702.50 | Open Gap | 26.00 | 1,294.50 | 1,275.25 | |

| 1,702.50 | nVPOC | ||||

| 1,701.75 | HVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,697.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,695.25 | Monthly VAH | 1,701.50 | 1,686.00 | 1,301.25 | 1,275.00 |

| 1,694.50 | PD High | 1,698.25 | 1,682.75 | 1,294.75 | 1,268.50 |

| 1,691.75 | VPOC | 1,695.00 | 1,679.50 | ||

| 1,690.75 | SETTLE | 1,691.75 | 1,676.25 | ||

| 1,687.00 | cVPOC | *BOLD indicates primary objectives | |||

| 1,687.00 | RTH MP | ||||

| 1,687.00 | ETH MP | ||||

| 1,679.25 | PD Low | ||||

| 1,673.00 | LVN | ||||

| 1,671.50 | Monthly TC | ||||

| 1,670.00 | HVN | ||||

| 1,665.50 | LVN | ||||

| 1,661.00 | LVN | ||||

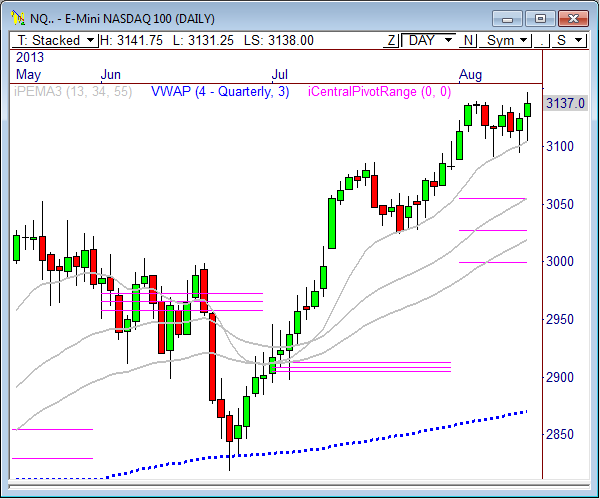

E-Mini NASDAQ 100

From yesterday’s report, “we could see another wave of weakness back toward 3112 to 3117.25. Any drop into this zone should be seen as a short term buying opportunity. The current pre-market low of 3123.25 forecasts bull targets of 3137.25 and 3144.25.”

The E-Mini NASDAQ 100 futures opened Tuesday’s market with early weakness into our buy zone, and even tested price levels below it between 3105 and 3110, before finding responsive buyers. The buying spree led to a nice upside recovery the rest of the session, with each of the upside targets being reached at 3137.25 and 3144.25.

The NQ remains much stronger than the broader market right now, and even pushed above the important 3140 resistance level. If the market can convert 3140 to support, we could see quite an upside push ahead. However, if the market rejects 3140 we could see another test down below at 3100.

Short term, watch 3130 as the near-term pivot in the NQ – long above, short below. The current pre-market low of 3131.25 forecasts bull targets at 3145.25 and 3152.25, while the current overnight high of 3141.75 suggests bear targets at 3127.75 and 3120.75.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Wed, Aug 14, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,160.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 3,148.00 | PD High | 28 | 3,141.75 | 3,131.25 | |

| 3,141.00 | Monthly H3 | AWR (10) | WH | WL | |

| 3,139.25 | VPOC | 65.25 | 3,148.00 | 3,094.25 | |

| 3,138.50 | LVN | ||||

| 3,138.50 | SETTLE | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,132.25 | HVN | BULL | BEAR | BULL | BEAR |

| 3,126.50 | RTH MP | 3,166.25 | 3,127.75 | 3,159.50 | 3,099.06 |

| 3,126.50 | ETH MP | 3,159.25 | 3,120.75 | 3,143.19 | 3,082.75 |

| 3,116.00 | cVPOC | 3,152.25 | 3,113.75 | ||

| 3,110.00 | HVN | 3,145.25 | 3,106.75 | ||

| 3,105.25 | LVN | *BOLD indicates primary objectives | |||

| 3,104.75 | PD Low | ||||

| 3,104.75 | 13PEMA | ||||

| 3,093.00 | HVN | ||||

| 3,089.50 | LVN | ||||

| 3,075.00 | HVN | ||||

| 3,069.50 | nVPOC | ||||

| 3,062.75 | LVN | ||||

| 3,034.00 | HVN | ||||

Crude Oil

From yesterday’s report, “Crude continues to trade within a clear trading range that spans from 102.22 to 109, seen in the daily chart. Crude is now trying to hold above the midpoint of the range at 105.75. If this level can hold, and especially 105, we could see another rise toward the top of the range between 108 and 109 soon.”

Crude Oil futures continue to trend higher within the boundaries of the trading range that has formed from 102.22 to 109, seen in the daily chart. Short term, Crude remained above the fast 13-period PEMA and continues to hold above the center of the range at 105.75. If price remains above the 105 to 105.50 zone, we could see another round of buying that lifts price beyond the recent 107.20 high.

The composite VPOC is 105.97, which means price is currently trading around a large HVN, which could lead to chop between 105.50 and 107. Eventually, a break away from this zone will spark the next key move in Crude.

The current pre-market high of 106.69 forecasts bear targets at 105.58 and 105.02, while the pre-market low of 105.92 suggests upside targets at 107.04 and 107.59, and 108.15.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Wed, Aug 14, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.68 | Monthly H3 | 2.23 | 106.69 | 105.92 | |

| 108.48 | LVN | AWR (10) | WH | WL | |

| 108.00 | LVN | 5.21 | 107.20 | 105.03 | |

| 107.59 | nVPOC | ||||

| 107.55 | Monthly VAH | DAILY TARGETS | WEEKLY TARGETS | ||

| 107.33 | LVN | BULL | BEAR | BULL | BEAR |

| 107.01 | PD High | 108.71 | 105.58 | 110.24 | 103.29 |

| 107.00 | LVN | 108.15 | 105.02 | 108.94 | 101.99 |

| 106.83 | HVN | 107.59 | 104.46 | ||

| 106.77 | SETTLE | 107.04 | 103.90 | ||

| 106.38 | ETH MP | *BOLD indicates primary objectives | |||

| 106.28 | RTH MP | ||||

| 106.11 | VPOC | ||||

| 105.97 | cVPOC | ||||

| 105.56 | PD Low | ||||

| 105.42 | HVN | ||||

| 104.89 | HVN | ||||

| 104.04 | LVN | ||||

| 103.09 | HVN | ||||

| 102.64 | nVPOC | ||||

| 102.25 | LVN | ||||

Gold

From yesterday’s report, “Short term, watch the 1322 support level for early directional bias. If price remains above this level, we could see another rally toward resistance at 1348. Otherwise, a violation could send prices back toward the midpoint of the recent rally, which currently lies at 1307.80.”

Gold violated the 1322 support zone during Tuesday’s market, which eventually led to a test of our bear target at 1316 by the early evening. As it turns out, price bottomed out at 1315.10 and pushed back to 1322 where it continues to trade at the moment.

Continue to watch 1322 very closely. If price can push above 1328, we could see some decent upside strength back toward 1340. However, if 1328 remains untouched, we will likely see another wave of weakness back toward 1310.50, which is a HVN.

The current high of 1326.70 forecasts bear targets at 1313.70 and 1307.20, while the pre-market low of 1315.10 suggest bulls targets at 1328.10 and 1334.60.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Wed, Aug 14, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,371.80 | Monthly R1 | ADR (10) | ONH | ONL | |

| 1,351.20 | Monthly H3 | 26 | 1,326.70 | 1,315.10 | |

| 1,348.40 | Monthly VAH | AWR (10) | WH | WL | |

| 1,339.70 | nVPOC | 48.00 | 1,343.70 | 1,313.50 | |

| 1,338.10 | LVN | ||||

| 1,335.40 | PD High | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,329.40 | ETH MP | BULL | BEAR | BULL | BEAR |

| 1,329.00 | cVPOC | 1,347.60 | 1,313.70 | 1,361.50 | 1,307.70 |

| 1,326.60 | RTH MP | 1,341.10 | 1,307.20 | 1,349.50 | 1,295.70 |

| 1,321.00 | VPOC | 1,334.60 | 1,300.70 | ||

| 1,320.60 | SETTLE | 1,328.10 | 1,294.20 | ||

| 1,317.80 | PD Low | *BOLD indicates primary objectives | |||

| 1,316.70 | LVN | ||||

| 1,313.60 | HVN | ||||

| 1,310.50 | HVN | ||||

| 1,309.90 | nVPOC | ||||

| 1,307.00 | LVN | ||||

| 1,300.90 | Monthly TC | ||||

| 1,296.30 | LVN | ||||

| 1,291.70 | HVN | ||||

| 1,284.10 | nVPOC | ||||

| 1,270.50 | LVN | ||||

Pingback: Hello GOLD Rally! | PivotBoss