What a wild end to a great week in the market. The Fed definitely provided some great volatility Wednesday and into the end of the week, which will continue to spill over into next week’s trading. As a matter of fact, I think next week could be extremely important to how the markets play out the rest of the month and heading into October.

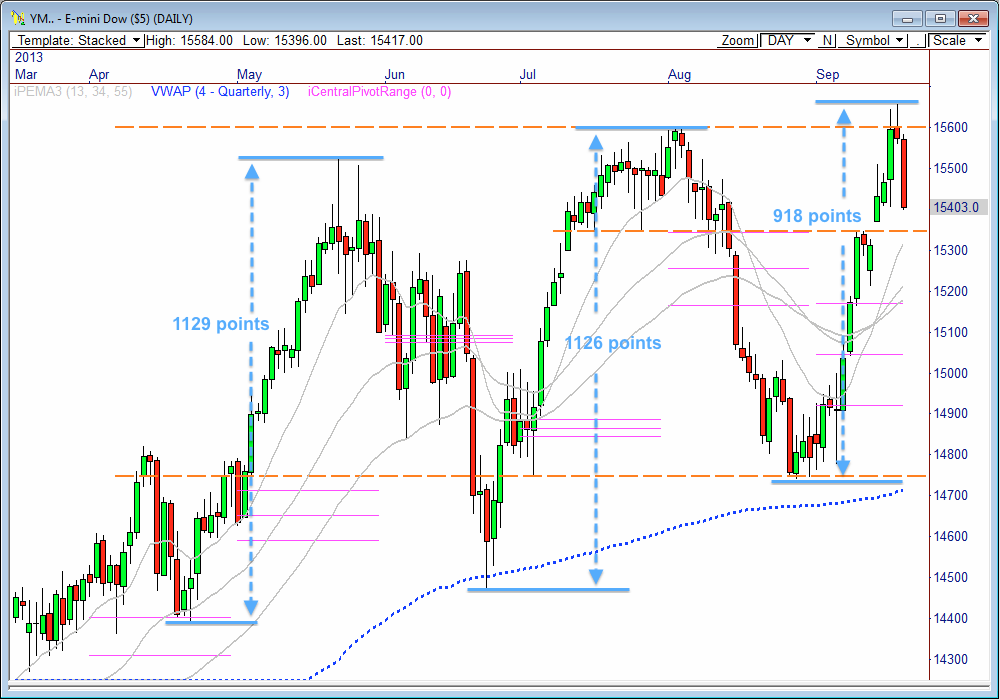

I wanted to provide some analysis for the mini Dow futures, because the daily and weekly charts are fantastic. Take a look at the daily chart below. What’s fascinating about the daily chart is how price has moved in near-perfect measured moves.

The last two major swing moves higher measured 1129 and 1126 points, respectively. The latest move has been “only” 918 points from the recent swing low of 14740. We can take this one of two ways: failure, or continuation? If we continue higher in the measured form of the recent bull swings, then we still have a target at 15865 to reach.

However, the YM is currently rejecting the 15600 round level, which makes me quite suspicious of a correction ahead, which may have already started.

The weekly chart shows price has formed a bearish tail after dropping from 15600, which could pave the way to 14800 down the road. There is a ton of bullish confluence at 14800, which could offer an amazing buy opportunity heading into the end of the year.

Here are the Monthly and Weekly ADR Targets to watch:

| Sep 20, 2013 | PivotBoss ADR METHOD TARGETS | ||||||||

| MONTHLY | WEEKLY | ||||||||

| AMR (10) | MH | ML | Range | AWR (5) | WH | WL | Range | ||

| E-Mini S&P 500 | 78.75 | 1726.75 | 1630.75 | 96.00 | 33.25 | 1702.50 | 1702.50 | 0.00 | |

| BULL | 1689.81 | 1709.50 | 1727.44 | 1735.75 | |||||

| BEAR | 1648.00 | 1667.69 | 1669.25 | 1677.56 | |||||

| E-Mini NASDAQ 100 | 147.00 | 3241.25 | 3076.00 | 165.25 | 70.25 | 3216.50 | 3216.50 | 0.00 | |

| BULL | 3186.25 | 3223.00 | 3269.19 | 3286.75 | |||||

| BEAR | 3094.25 | 3131.00 | 3146.25 | 3163.81 | |||||

| Crude Oil Futures | 9.41 | 110.70 | 104.21 | 6.49 | 5.03 | 104.67 | 104.67 | 0.00 | |

| BULL | 111.27 | 113.62 | 108.44 | 109.70 | |||||

| BEAR | 101.29 | 103.64 | 99.64 | 100.90 | |||||

| Gold Futures | 141.4 | 1416.4 | 1291.5 | 124.9 | 58.0 | 1332.5 | 1332.5 | 0.0 | |

| BULL | 1397.6 | 1432.9 | 1376.0 | 1390.5 | |||||

| BEAR | 1275.0 | 1310.4 | 1274.5 | 1289.0 | |||||

| E-Mini S&P 400 | 69.2 | 1260.9 | 1169.1 | 91.8 | 33.1 | 1241.6 | 1241.6 | 0.0 | |

| BULL | 1221.0 | 1238.3 | 1266.4 | 1274.7 | |||||

| BEAR | 1191.7 | 1209.0 | 1208.5 | 1216.8 | |||||

| mini Dow Futures | 700 | 15658 | 14761 | 897 | 288 | 15403 | 15403 | 0 | |

| BULL | 15286 | 15461 | 15619 | 15691 | |||||

| BEAR | 14958 | 15133 | 15115 | 15187 | |||||

| Russell 2000 Mini | 60.1 | 1078.8 | 1006.2 | 72.6 | 28.0 | 1069.4 | 1069.4 | 0.0 | |

| BULL | 1051.3 | 1066.3 | 1090.4 | 1097.4 | |||||

| BEAR | 1018.7 | 1033.7 | 1041.4 | 1048.4 | |||||