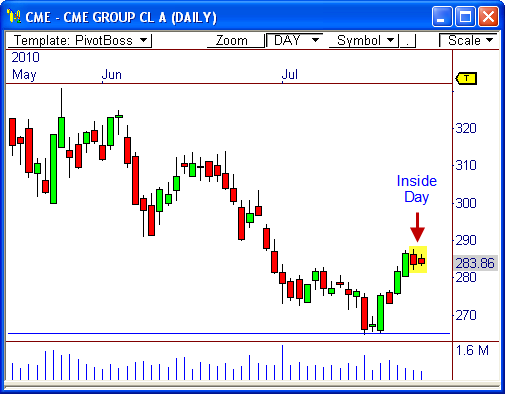

CME Group ($CME) has made a great run from support after my recent blog post entitled “3 Stocks to Watch”, rallying nearly 15 points in the last few sessions. The stock is now winding up for another breakout opportunity. Here’s why..

Inside Day

The daily chart of $CME shows price has formed an Inside Bar relationship over the last two days of trading. As you recall, this relationship occurs when yesterday’s range (from high to low) falls within the range of the prior session.

This relationship usually results in a great breakout opportunity – in either direction.

Watch the outer boundaries of yesterday’s range ($286.50 and $283) for breakout confirmation.

Since $CME has rallied nicely from major support, I suspect an upside break could be the ticket. However, this is for the market to decide.

Inside Value

The 15-minute chart shows $CME has formed an Inside Value relationship, which occurs when today’s value area falls within the range of the prior session’s value area.

Much like the Inside Day relationship, this occurance usually results in a nice breakout opportunity, thereby giving us multi-timeframe confirmation.

Again, watch the outer boundaries of yesterday’s price range for signs of a breakout opportunity – $286.50 and $283.

A breakout from this range could spark the next 10 point move, so watch it closely!

Let’s see what happpens!

Targets Reached!

Recently, the price targets were reached for two stocks I blogged about. Hooray!

$FSLR Reached $140! Is First Solar Ready for $140?.

$ABX Reached $40! 3 Reasons to Sell $ABX.

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss