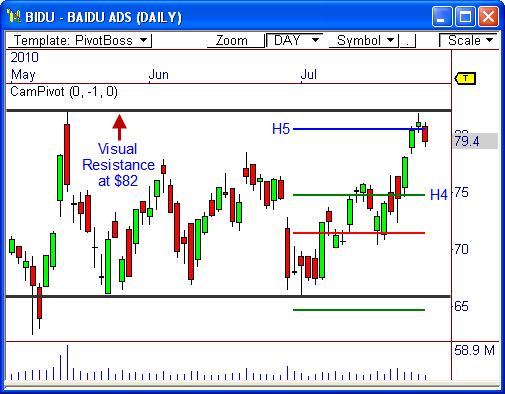

Baidu, Inc. ($BIDU) has been an incredibly strong stock over the last 18 months, rallying from $10 to $82 during this stretch. However, $BIDU could be headed for a short term pull-back, which means we could see price drop back toward $75 over the next few sessions.

Confluence of Resistance

$BIDU was rejected at the all-time high of $82 recently, creating a bit of profit-taking over the last two days.

The $82 level is not only visual resistance of the last three months, but $80.50 also happens to be the H5 Camarilla breakout target, creating a confluence of resistance at this zone.

The fact that price closed back below the H5 pivot indicates a potential run back to H4 at $74.70.

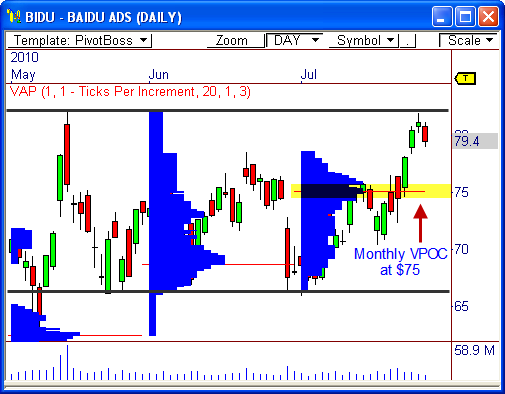

VPOC at $75

Not only is H4 near $75, but the Volume Point of Control (VPOC) for July is at $75, as well.

If a pull-back does indeed occur in this stock, look for price to retrace back to the VPOC before buying enters the market.

Of course, if price blows through $75, support at the bottom of the trading range could begin to play a role in the stock’s target at $66.

While the longer term prospects for this stock remain healthy, a near-term retracement could be seen back to $75, which could be helpful to another round of buying pressure.

All bets are off if price closes above $82, however.

Let’s see what happens!

Read more about the Camarilla Equation.

Read more about Volume at Price.

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss