PB View

Is today the day that the S&P 500 futures hit 1700? We’ll see, but whether it happens today, or later in the week, I can’t see price getting this close without hitting this level.

The S&P 500 remains quite bullish, and continues to trend higher above stacked and sloped moving averages, and above higher value pivot ranges day after day. This makes buy the dip the primary method of taking profits from the market. If the NASDAQ can put together an upmove today, I think the S&P finally sees 1700. But wow, I don’t think 10 points has ever seems so far away.

Continue to watch Gold, as the 1325 level is another key fulcrum that could spark the next big move, while Crude continues to trend lower, making every rip a selling opportunity until proven otherwise.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

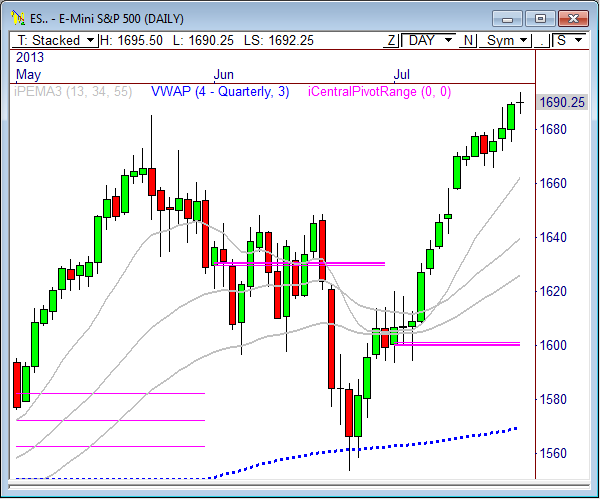

E-Mini S&P 500

In yesterday’s ES report I wrote, “An early dip between 1684.50 and 1686.25 could be a nice buy zone this morning.”

The E-Mini S&P 500 opened Monday’s marke with modest weakness Monday morning and dropped right into our buy zone of 1684.50 to 1686.25 and rallied quietly to 1693 before calling it a day. Always nice to start the week with a high-probability bounce for some decent points during a lazy summer trading day.

For today’s session, the 1692 to 1695.50 offers a short term range to watch for a breakout. Below 1692 sees 1689 and 1689.75, with a shot to retest 1686.

However, a strong, uptrending market has been the current theme, and buying the dips remains the primary focus. As such, a move into the 1686 to 1688 zone could offer buys that lead price higher. If 1690.75 remains the low of the day, then there are high-probability odds of reaching 1696.75 and 1700, which is actually the day’s primary ADR target, in addition to the level that the market wants to hang on the trophy wall.

Today’s scheduled economic news:

8:00am CT HPI m/m

9:00am CT Richmond Manufacturing Index

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Jul 23, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,708.25 | Monthly R2 | ADR (10) | ONH | ONL | |

| 1,697.75 | Monthly H5 | 13 | 1,695.50 | 1,690.25 | |

| 1,695.75 | Fib Ext | AWR (10) | WH | WL | |

| 1,693.00 | PD High | 43.00 | 1,695.50 | 1,685.50 | |

| 1,690.75 | VPOC | ||||

| 1,690.50 | SETTLE | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,689.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,685.50 | PD Low | 1,706.50 | 1,689.00 | 1,728.50 | 1,663.25 |

| 1,682.75 | nVPOC/Fib Ext | 1,703.25 | 1,685.75 | 1,717.75 | 1,652.50 |

| 1,679.25 | LVN | 1,700.00 | 1,682.50 | ||

| 1,677.25 | nVPOC | 1,696.75 | 1,679.25 | ||

| 1,673.00 | LVN | *BOLD indicates primary objectives | |||

| 1,670.50 | nVPOC | ||||

| 1,670.00 | cVPOC | ||||

| 1,666.25 | LVN | ||||

| 1,664.25 | nVPOC | ||||

| 1,660.50 | LVN | ||||

| 1,656.00 | HVN | ||||

| 1,652.25 | LVN | ||||

| 1,648.75 | Open Gap | ||||

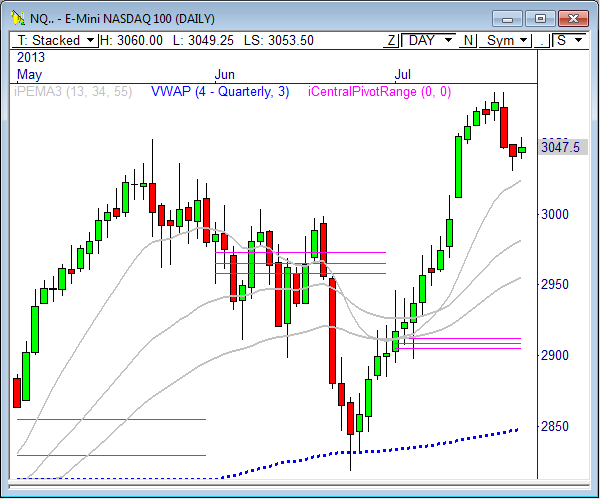

E-Mini NASDAQ 100

In yesterday’s NQ report I wrote, “If price can remain above 3025.50, we have a shot to retest prior support between 3061 and 3067. This is the zone that the NQ must recover in order to head higher. A failure in this zone could forecast a multiple-day move lower, especially if 3025.50 is broken.”

The NASDAQ opened Monday’s market with a gap up, quickly filled the gap, and then formed an opening 30-minute range that held throughout the session. That’s what you call a range day! But Monday’s range market could lead to Tuesday’s breakout session.

Watch Monday’s range (3055 up, 3038 dn) for a potential breakout Tuesday, as a violation could provide some decent movement toward the day’s primary targets. An upside push through 3055 could spark a move toward the important zone of resistance above between 3061 and 3067, and the day’s primary bull target of 3069.

The 60-minute chart shows price continues to hold above gap support at 3025, which continues to be the main zone of support. Hold this level, and more upside is seen. Break this zone, and we slide big.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Jul 23, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,096.00 | Monthly H5 | ADR (10) | ONH | ONL | |

| 3,086.00 | LVN | 26.5 | 3,060.00 | 3,049.25 | |

| 3,074.75 | cVPOC | AWR (10) | WH | WL | |

| 3,074.50 | nVPOC | 94.25 | 3,060.00 | 3,038.50 | |

| 3,062.75 | LVN | ||||

| 3,061.50 | Fib Ext | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,055.25 | PD High | BULL | BEAR | BULL | BEAR |

| 3,052.00 | LVN | 3,082.38 | 3,046.75 | 3,132.75 | 2,989.31 |

| 3,048.00 | VPOC | 3,075.75 | 3,040.13 | 3,109.19 | 2,965.75 |

| 3,047.75 | SETTLE | 3,069.13 | 3,033.50 | ||

| 3,038.50 | PD Low | 3,062.50 | 3,026.88 | ||

| 3,032.25 | Fib Ext | *BOLD indicates primary objectives | |||

| 3,034.25 | nVPOC | ||||

| 3,029.50 | nVPOC | ||||

| 3,026.25 | LVN | ||||

| 3,011.50 | HVN | ||||

| 3,008.00 | nVPOC | ||||

| 2,997.00 | Open Gap | ||||

| 2,995.00 | nVPOC | ||||

| 2,991.00 | HVN | ||||

Crude Oil

In yesterday’s Crude report I wrote, “Short term, watch the overnight support and resistance zones of 107.85 and 108.55 for early directional cues. A breakout from this range could spark the day’s primary move.”

Crude opened the week with a break through the 107.85 zone of overnight support and dropped sharply Monday morning, taking out several key targets along the way. Crude trended lower throughout the session and eventually closed RTH trading back below the 107 level, which could forecast more selling during Tuesday’s session.

Friday’s selling tail in the daily chart coupled with Monday’s downtrend leads me to believe that selling the early rally in Crude might be the best early play for Tuesday’s session. A push into the 106.30 to 106.60 zone could be the first sell zone to watch early in the day. If this level holds as resistance, it could be another “sell the rips” day.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Jul 23, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 109.38 | Fib Ext | 2.15 | 107.22 | 105.59 | |

| 108.60 | PD High | AWR (10) | WH | WL | |

| 108.32 | LVN | 5.90 | 108.79 | 105.80 | |

| 106.84 | SETTLE | ||||

| 107.71 | Monthly R3 | DAILY TARGETS | WEEKLY TARGETS | ||

| 107.60 | cVPOC | BULL | BEAR | BULL | BEAR |

| 107.34 | VPOC | 108.28 | 106.15 | 111.70 | 104.37 |

| 106.55 | PD Low | 107.74 | 105.61 | 110.23 | 102.89 |

| 106.69 | LVN | 107.20 | 105.07 | ||

| 105.77 | Fix Ext | 106.67 | 104.53 | ||

| 106.05 | LVN | *BOLD indicates primary objectives | |||

| 105.97 | nVPOC | ||||

| 105.74 | HVN | ||||

| 105.33 | LVN | ||||

| 104.37 | LVN | ||||

| 104.20 | LVN | ||||

| 103.52 | Open Gap | ||||

Gold

In yesterday’s Gold report I wrote, “Gold has already reached the day’s 125% bull target at 1324.10. The 1330 level is the next highest bull target for the day. Look to buy pullbacks today as long as price remains above 1319.”

Gold saw a major rally yesterday after price shot through the 1300 level during Sunday night’s trading and continued higher throughout Monday’s session, reaching 1330 along the way and topping out at 1339.10. And just like that, a 40-point rally puts Gold well above the 1300 level, which had been clear-cut resistance for a month.

The daily and weekly charts show Gold is pulling back within the current overall downtrend, which means we could begin to see a point of short term exhaustion that could eventually lead to another “sell the rip” opportunity. However, there’s still some upside left that could be explored before selling enters the market, if any even occurs.

Keep an eye on 1348 and 1360 above, which could be zones where buyers may begin to look to hand off their positions to sellers. Short term, continued strength should be seen above 1300, and especially if price remains above 1325. A violation of 1325 will shift the focus to short term bearish.

Watch 1330 for early strength, with targets at 1338.10 and 1344.40. A break through 1325 forecasts a move to 1319 and 1312.70.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Jul 23, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,385.50 | cVPOC | ADR (10) | ONH | ONL | |

| 1,357.80 | Monthly H4 | 25.1 | 1,337.80 | 1,325.60 | |

| 1,347.40 | 55PEMA | AWR (10) | WH | WL | |

| 1,347.20 | Fib Ext | 60.20 | 1,339.10 | 1,295.40 | |

| 1,339.10 | PD High | ||||

| 1,336.00 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,335.90 | SETTLE | BULL | BEAR | BULL | BEAR |

| 1,326.40 | VPOC | 1,356.98 | 1,325.25 | 1,355.60 | 1,293.95 |

| 1,325.50 | LVN | 1,350.70 | 1,318.98 | 1,340.55 | 1,278.90 |

| 1,319.60 | LVN | 1,344.43 | 1,312.70 | ||

| 1,317.90 | PD Low | 1,338.15 | 1,306.43 | ||

| 1,316.00 | HVN | *BOLD indicates primary objectives | |||

| 1,310.10 | LVN | ||||

| 1,309.90 | Fib Ext | ||||

| 1,301.30 | Monthly TC | ||||

| 1,297.00 | LVN | ||||

| 1,292.70 | nVPOC | ||||

| 1,288.10 | LVN | ||||

| 1,283.60 | HVN | ||||

Pingback: Still Waiting on 1700 | PivotBoss