Last week I gave you 3 Reasons to Sell $CME – a stock that I believed was poised to head lower. Gladly, I took my own advice and netted nearly 10 points in $CME while I was on vacation!

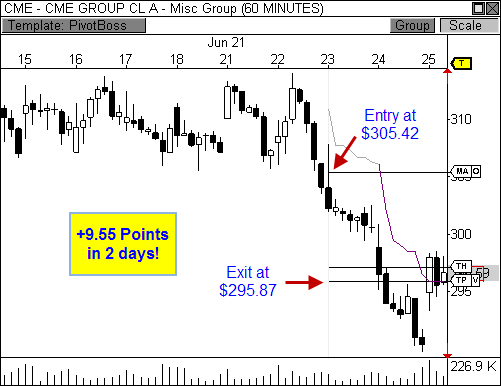

I shorted the stock from $305.42 the day before I left for the beach and price dropped nicely during the session. Since I believed $CME would drop into the $280’s (it reached $289.67), I set up a basic trade plan that would automatically manage the trade for me, including the handling all my stops and profit targets.

Price didn’t reach my profit objective of $282 (not yet, anyway), so my trailing profit stop did all the work and trailed price until an exit was triggered – netting me a gain of $9.55 in just two days!

Obviously, there were several compelling reasons why I believed $CME would drop, including the channel, the moving average crossover signal, and the Outside Reversal signal.

However, this trade exemplifies my motto of planning the trade, and trading the plan – a concept that I believe is vital to successful trading.

Hopefully you were able to take advantage of the opportunity! If you did, let me know in the comments section below!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Hi Frank,

I played the CME trade using put options and made 50%…great call!! Looks like we could have a fun week with the market.

Vicki

Wow, that’s great Vicki! With the Inside Day developing in the indexes, we could see some major fireworks this week!

Cheers!

Frank